45 what is zero coupon bonds

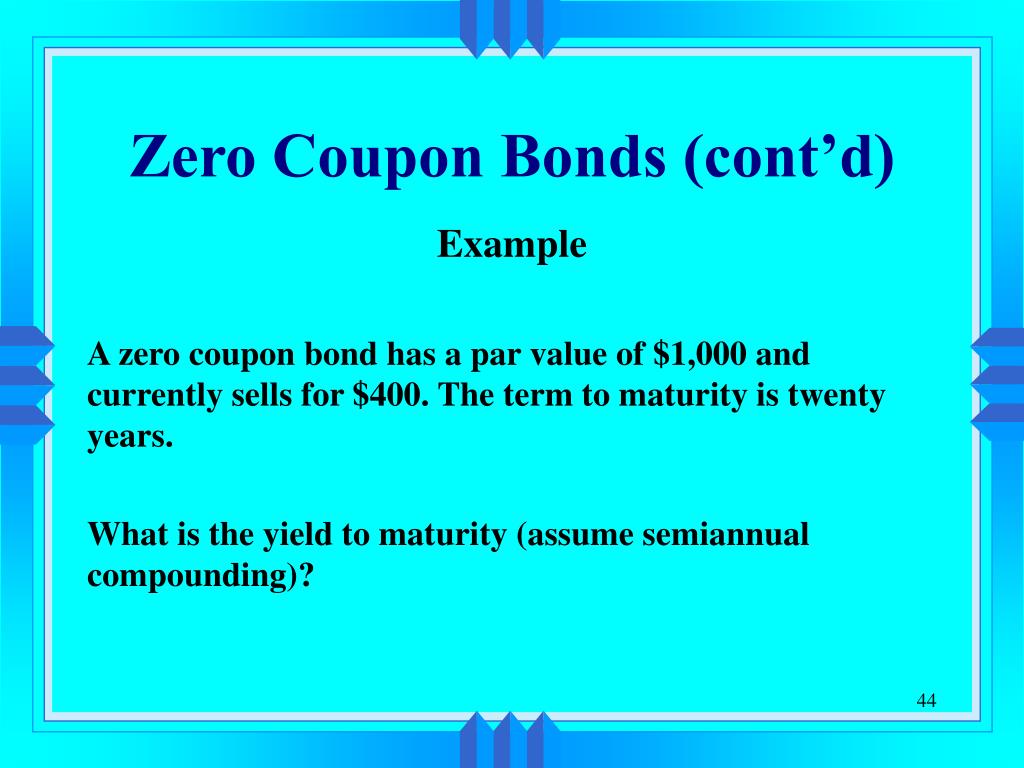

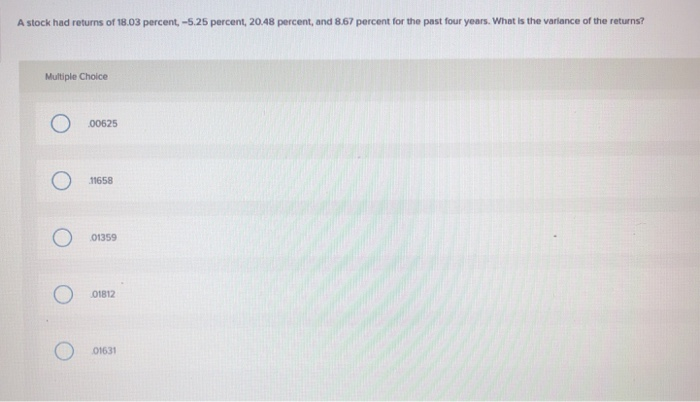

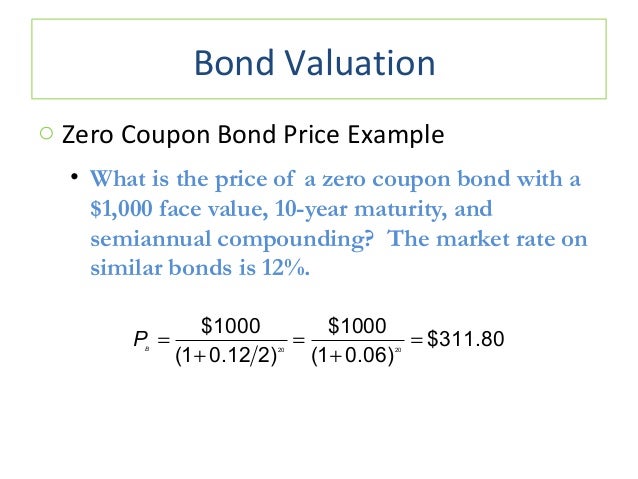

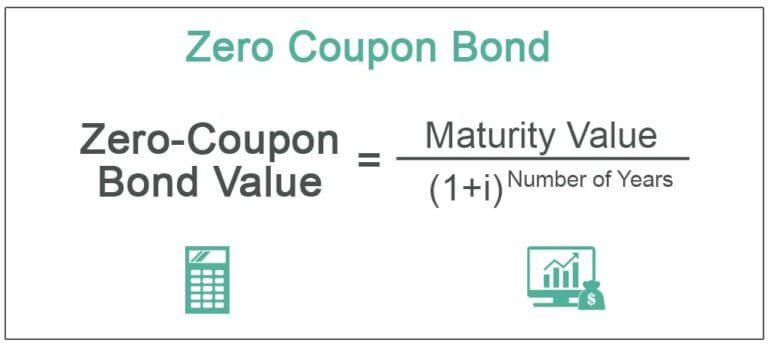

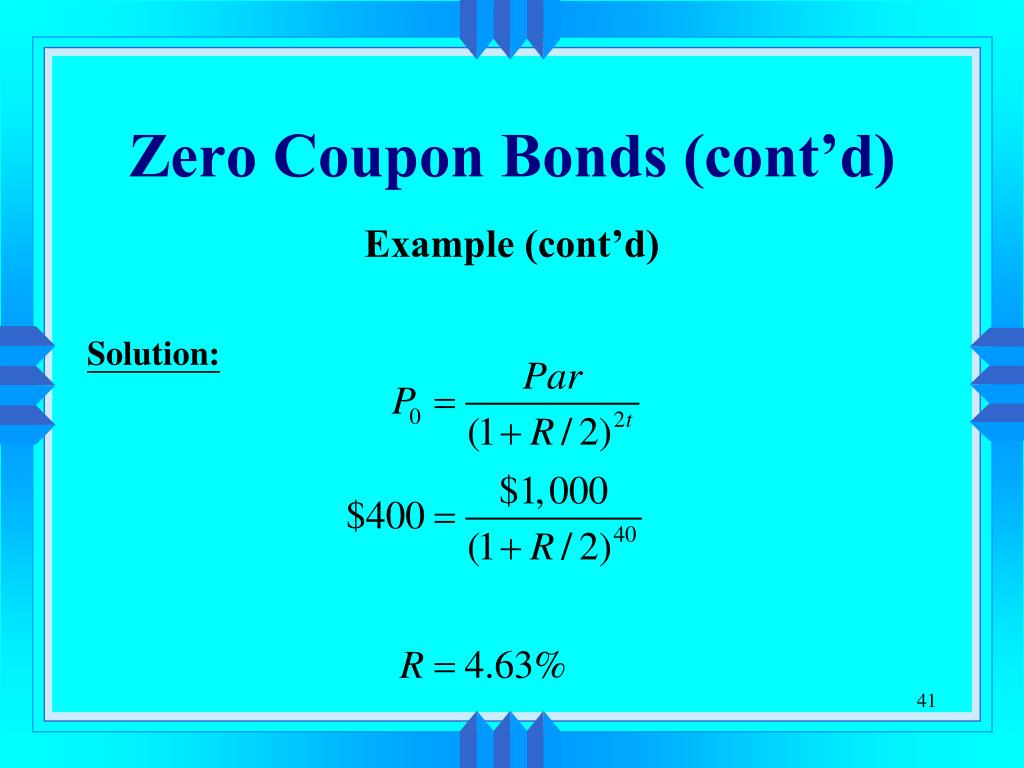

Zero-Coupon Bond: Formula and Excel Calculator Zero-coupon bonds are debt obligations structured without any required interest payments (i.e. "coupons") during the lending period, as implied by the name. Instead, the difference between the face value and price of the bond could be thought of as the interest earned. What is a Zero-Coupon Bond? Definition, Features ... Definition: A zero-coupon bond, as the name suggests, it is a financial instrument which does not allow a regular interest payment to the investor. Moreover, it is a bond which is issued at a meagre market price (discounted price) in comparison to its face value. And it is redeemable on or after a specified maturity date at the par value itself.

Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond (Also known as Pure Discount Bond or Accrual Bond) refers to those bonds which are issued at a discount to its par value and makes no periodic interest payment, unlike a normal coupon-bearing bond. In other words, its annual implied interest payment is included in its face value which is paid at the maturity of such bond.

What is zero coupon bonds

Zero-Coupon Bond Definition - Investopedia A zero-coupon bond, also known as an accrual bond, is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for its full face value. Zero Coupon Bond - Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don’t mature for ten, fifteen, or more years. Zero-Coupon Bond - Definition, How It Works, Formula As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of moneyTime Value of MoneyThe time value of money is a basic financial concept that holds that money in the present is worth more than the same sum of money to be received in the future.. The time value o...

What is zero coupon bonds. What does it mean if a bond has a zero coupon rate? A bond's coupon rate is the percentage of its face value payable as interest each year. A bond with a coupon rate of zero, therefore, is one that pays no interest. However, this does not mean the ... Zero-Coupon Convertible - Investopedia A zero-coupon convertible is a convertible bond issued by a corporation that pays no regular interest to bondholders. Because of the zero-coupon feature, these convertibles are sold at a discount... Advantages and Risks of Zero Coupon Treasury Bonds Zero-coupon U.S. Treasury bonds are also known as Treasury zeros, and they often rise dramatically in price when stock prices fall. Zero-coupon U.S. Treasury bonds can move up significantly when... Zero Coupon Bond Definition and Example | Investing Answers A zero coupon bond is a bond that makes no periodic interest payments and therefore is sold at a deep discount from its face value. The buyer of the bond receives a return by the gradual appreciation of the security, which is redeemed at face value on a specified maturity date.

Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww Zero Coupon Bond, also known as the discount bond, is purchased at a discounted price and does not pay any coupons or periodic interests to the fundholders. Money invested in Zero Coupon Bond does not generate a regular interest during the tenure. 14.3 Accounting for Zero-Coupon Bonds - Financial Accounting A zero-coupon bond is one that is popular because of its ease. The face value of a zero-coupon bond is paid to the investor after a specified period of time but no other cash payment is made. There is no stated cash interest. Money is received when the bond is issued and money is paid at the end of the term but no other payments are ever made. What Is a Zero-Coupon Bond? | The Motley Fool May 04, 2022 · Zero-coupon bonds are debt securities that are sold at deep discounts to face value. As their name indicates, they don't pay periodic interest payments, but they do reach full maturity at a certain... How Do Zero Coupon Bonds Work? - SmartAsset A zero coupon bond differs from regular bonds in that they do not pay income in the form of coupons. We explain how it works and where to invest in them. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators How Much House Can I Afford? Mortgage Calculator Rent vs Buy

What is a Zero Coupon Bond? Who Should Invest? | Scripbox A zero coupon bond is a type of fixed income security that does not pay any interest to the bondholder. It is also known as a discount bond. These bonds are issued at a discount to the face value. In other words, it trades at a deep discount. On maturity, the bond issuer pays the face value of the bond to the bondholder. How is a zero-coupon bond taxed? - Terasolartisans.com A zero-coupon bond is a discounted investment that can help you save for a specific future goal. A zero-coupon bond doesn't pay periodic interest, but instead sells at a deep discount, paying its full face value at maturity. Zeros-coupon bonds are ideal for long-term, targeted financial needs at a foreseeable time. ... Zero Coupon Bonds Explained (With Examples) - Fervent ... The value of a zero coupon bond is nothing but the Present Value of its Par Value. Zero Coupon Bond Example Valuation (Swindon Plc) Consider an example of Swindon PLC, which is issuing a zero coupon bond with a par value of £100 to be paid in one year's time. What is the price of this bond today, if the yield is 7%? What is the difference between a zero-coupon bond and a ... A zero-coupon bond will usually have higher returns than a regular bond with the same maturity because of the shape of the yield curve. Zero-coupon bonds are more volatile than coupon bonds, so...

Zero-Coupon Bond - Assignment Point A zero-coupon bond also called a discount bond or a deep discount bond pays no interest and trades at a discount to its face value. The lender retains the par (or face) value of the bond when it matures. A few bonds are given as zero-coupon instruments from the beginning, while others bonds change into zero-coupon instruments after a monetary establishment strips them of their coupons, and ...

What Is a Zero-Coupon Bond? Definition, Advantages, Risks A zero-coupon bond is a discounted investment that can help you save for a specific future goal. Tara Mastroeni. Nov 25, 2020, 10:09 AM. Save Article Icon. A bookmark. Email icon. An envelope. It ...

What Is a Zero-Coupon Bond? Definition, Advantages, Risks A zero-coupon bond doesn't pay periodic interest, but instead sells at a deep discount, paying its full face value at maturity. Zeros-coupon bonds are ideal for long-term, targeted financial needs...

What Is a Zero-Coupon Bond? | The Motley Fool Zero-coupon bonds are debt securities that are sold at deep discounts to face value. As their name indicates, they don't pay periodic interest payments, but they do reach full maturity at a certain...

Zero-Coupon Bonds: Pros and Cons Zero-coupon bonds are those bonds that are sold at a deep discount to their face value. This means that these bonds do not receive any periodic interest. Instead, the investors have to invest a lump sum amount at the beginning of their investment and get paid a higher lumpsum amount at the end of their investment.

What is a Zero-Coupon Bond? Definition and Meaning ... A zero-coupon bond, also known as a discount bond, is a type of bond that is purchased at a lower price than its face value. The face value is repaid when the bond reaches maturity. Bonds are kinds of debts or IOUs that corporations and governments sell and investors buy.

Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. That definition assumes a positive time value of money. It does not make periodic interest payments or have so-called coupons, hence the term zero coupon bond.

What is a Zero-Coupon Bond? - Robinhood A zero-coupon bond is different from other bonds in that it doesn't result in recurring interest income for the bondholder. Instead, the owner buys the bond at a discount. Then when the bond reaches maturity, the profit for the investor is the difference between the purchase price of the bond and its face value (aka par value).

Zero coupon bond definition - AccountingTools Zero coupon bond definition January 15, 2022 What is a Zero Coupon Bond? A zero coupon bond is a bond with no stated interest rate. Investors purchase these bonds at a considerable discount to their face value in order to earn an effective interest rate. An example of a zero coupon bond is a U.S. savings bond. Disadvantages of Zero Coupon Bonds

Zero Coupon Bond Yield: Formula, Considerations, and ... Zero-coupon bonds essentially lock the investor into a guaranteed reinvestment rate. This arrangement can be most advantageous when interest rates are high and when placed in tax-advantaged...

Zero-Coupon Bond - Definition, How It Works, Formula As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of moneyTime Value of MoneyThe time value of money is a basic financial concept that holds that money in the present is worth more than the same sum of money to be received in the future.. The time value o...

Zero Coupon Bond - Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don’t mature for ten, fifteen, or more years.

Zero-Coupon Bond Definition - Investopedia A zero-coupon bond, also known as an accrual bond, is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for its full face value.

Post a Comment for "45 what is zero coupon bonds"