38 zero coupon bond semi annual calculator

What Is Coupon Rate and How Do You Calculate It? - SmartAsset Dec 03, 2019 · For example, ABC Corporation could issue a 10-year, zero-coupon bond with a par value of $1,000. They might then sell it for $900. The purchaser would hold the note for 10 years and at the date of maturity would redeem it for $1,000, making $100 in profit. Bottom Line. A bond coupon rate can be a nice annual payout for a bond holder. Yield to Maturity Calculator | Good Calculators P is the price of a bond, C is the periodic coupon payment, r is the yield to maturity (YTM) of a bond, B is the par value or face value of a bond, Y is the number of years to maturity. Example 2: Suppose a bond is selling for $980, and has an annual coupon rate of 6%. It matures in five years, and the face value is $1000.

Interest Rate Converter | Convert annual to monthly, semi annual … You can also use this tool to compare two or more interest rates having different interest payment frequencies. For example, if you need to compare an interest rate of 12% p.a., payable monthly with an interest rate of 12.50% p.a., payable annually to find which one is expensive in terms of effective cost, convert the former into annual one or the latter into monthly one using this tool - …

Zero coupon bond semi annual calculator

Assignment Essays - Best Custom Writing Services Get 24⁄7 customer support help when you place a homework help service order with us. We will guide you on how to place your essay help, proofreading and editing your draft – fixing the grammar, spelling, or formatting of your paper easily and cheaply. How to calculate bond price in Excel? - ExtendOffice Calculate price of a semi-annual coupon bond in Excel Calculate price of a zero coupon bond in Excel For example there is 10-years bond, its face value is $1000, and the interest rate is 5.00%. Bond (finance) - Wikipedia The coupon rate is recalculated periodically, typically every one or three months. Zero-coupon bonds (zeros) pay no regular interest. They are issued at a substantial discount to par value, so that the interest is effectively rolled up to maturity (and usually taxed as such). The bondholder receives the full principal amount on the redemption ...

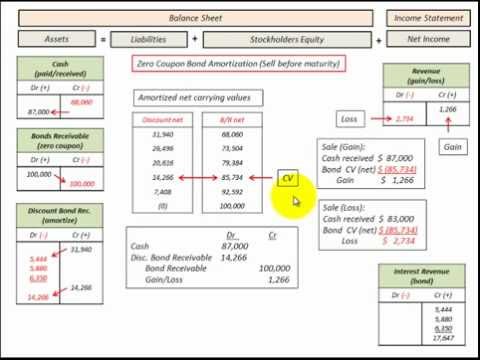

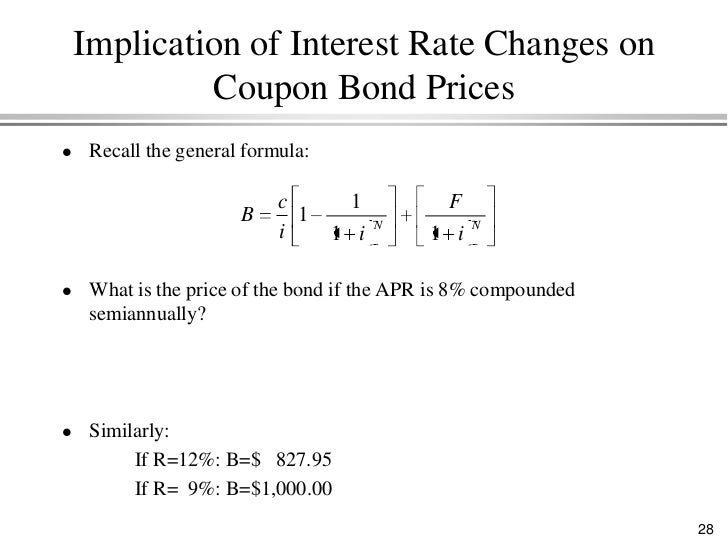

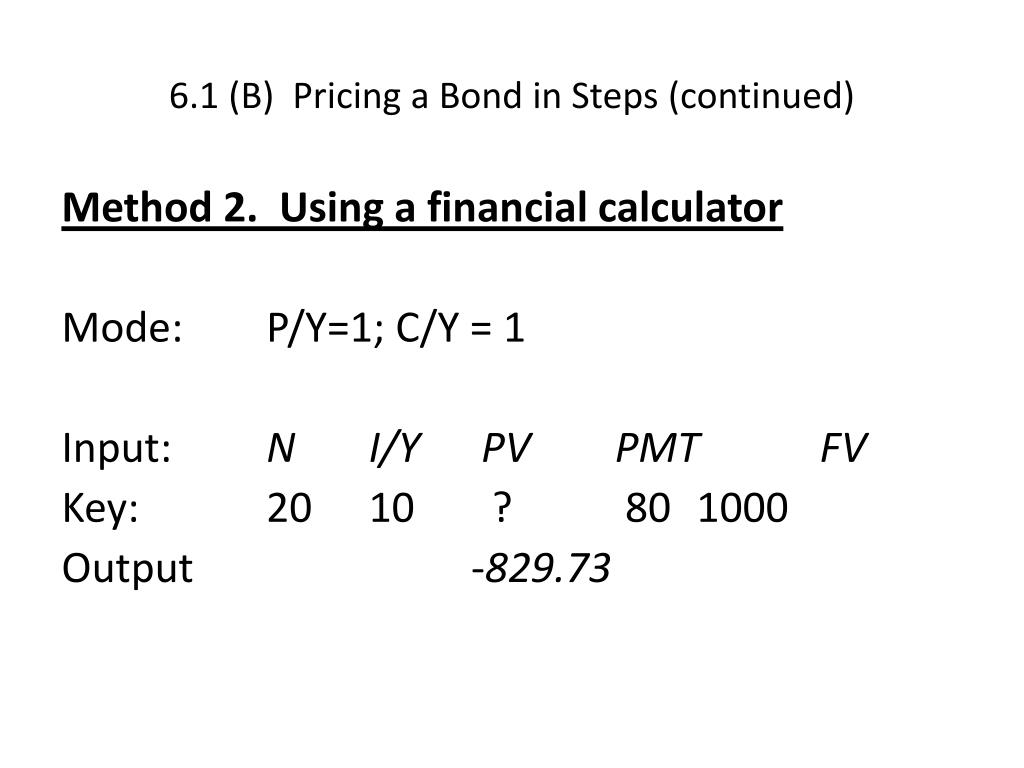

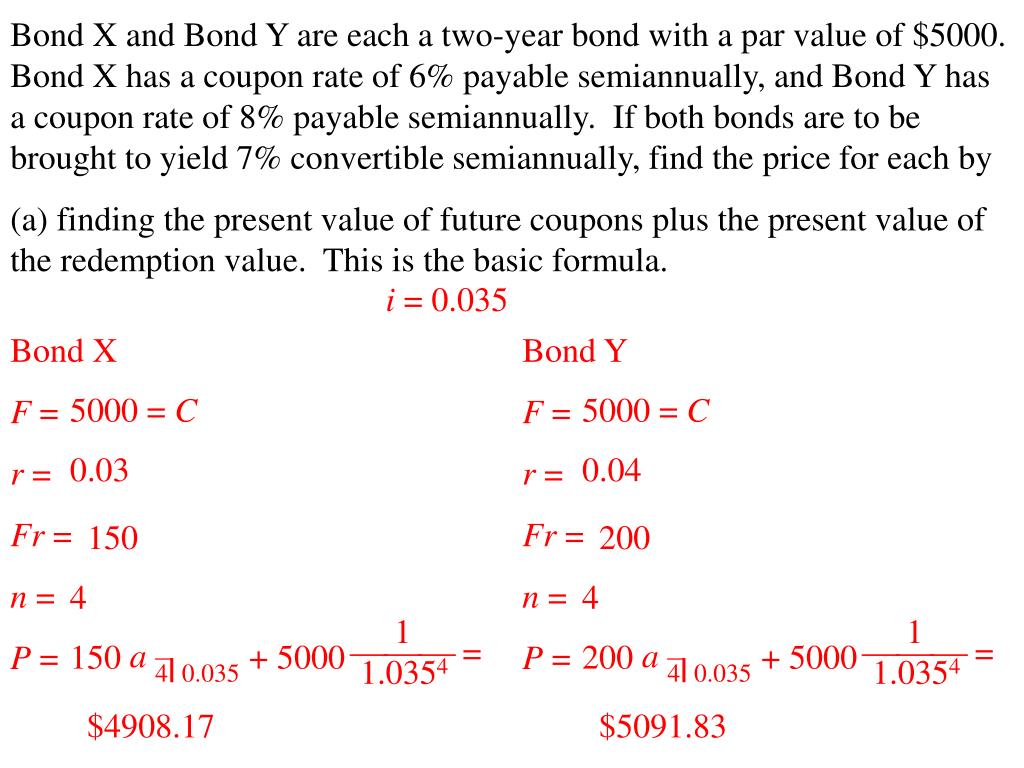

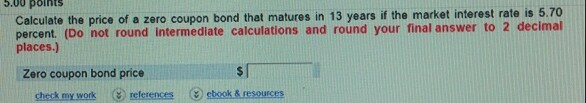

Zero coupon bond semi annual calculator. Zero-Coupon Bond: Formula and Calculator [Excel Template] If the zero-coupon bond compounds semi-annually, the number of years until maturity must be multiplied by two to arrive at the total number of compounding periods (t). Zero-Coupon Bond Value Formula. Price of Bond (PV) = FV / (1 + r) ^ t; Where: PV = Present Value; FV = Future Value; r = Yield-to-Maturity (YTM) t = Number of Compounding Periods How to Calculate the Price of a Bond With Semiannual Coupon … Apr 24, 2019 · How to Calculate the Price of a Zero Coupon Bond. ... In addition to getting semi-annual interest payments, bond issuers promise to repay the face value of bonds to investors at maturity. Depending on the particulars of a bond, you might pay more or less than its face value when you buy it, known as buying bonds at a premium or at a discount ... Zero Coupon Bond Value Calculator: Calculate Price, Yield to … After a user enters the annual rate of interest, the duration of the bond & the face value of the bond, this calculator figures out the current price associated with a specified face value of a zero-coupon bond. Interest is compounded semi-annually throughout the duration, or at the end of each fraction of a half-year for any fractional years ... Bond Yield Calculator - CalculateStuff.com To calculate current yield, we must know the annual cash inflow of the bond as well as the current market price. The bond pays out $21 every six months, so this means that the bond pays out $42 every year. The current market price of the bond is how much the bond is worth in the current market place.

Loan Calculator Coupon interest payments occur at predetermined intervals, usually annually or semi-annually. Zero-coupon bonds do not pay interest directly. Instead, borrowers sell bonds at a deep discount to their face value, then pay the face value when the bond matures. Users should note that the calculator above runs calculations for zero-coupon bonds. Bond Pricing Formula | How to Calculate Bond Price? | Examples Let us take an example of a bond with semi-annual coupon payments. Let us assume a company ABC Ltd has issued a bond having the face value of $100,000 carrying a coupon rate of 8% to be paid semi-annually and maturing in 5 years. ... Let us assume a company QPR Ltd has issued a zero-coupon bond with having a face value of $100,000 and maturing ... Yield to Maturity (YTM): Formula and Calculator [Excel Template] Semi-Annual Coupon Rate (%) = 6.0% ÷ 2 = 3.0%; Then, we must calculate the number of compounding periods by multiplying the number of years to maturity by the number of payments made per year. Number of Compounding Periods (n) = 10 × 2 = 20; As for our last input, we multiply the semi-annual coupon rate by the face value of the bond (FV) to ... Bond Yield to Maturity Calculator for Comparing Bonds So, a 10% coupon on a $10,000 bond would pay an annual interest of $1000. Again, these payments are often staggered throughout the year, so a bond holder's interest might be paid in biannual or quarterly installments. Fixed Rate Bonds – A fixed rate bond has a coupon that represents a fixed percentage of its par value.

What Is Bond Yield? - Investopedia May 31, 2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ... Bond (finance) - Wikipedia The coupon rate is recalculated periodically, typically every one or three months. Zero-coupon bonds (zeros) pay no regular interest. They are issued at a substantial discount to par value, so that the interest is effectively rolled up to maturity (and usually taxed as such). The bondholder receives the full principal amount on the redemption ... How to calculate bond price in Excel? - ExtendOffice Calculate price of a semi-annual coupon bond in Excel Calculate price of a zero coupon bond in Excel For example there is 10-years bond, its face value is $1000, and the interest rate is 5.00%. Assignment Essays - Best Custom Writing Services Get 24⁄7 customer support help when you place a homework help service order with us. We will guide you on how to place your essay help, proofreading and editing your draft – fixing the grammar, spelling, or formatting of your paper easily and cheaply.

Post a Comment for "38 zero coupon bond semi annual calculator"