40 10 year treasury bond coupon rate

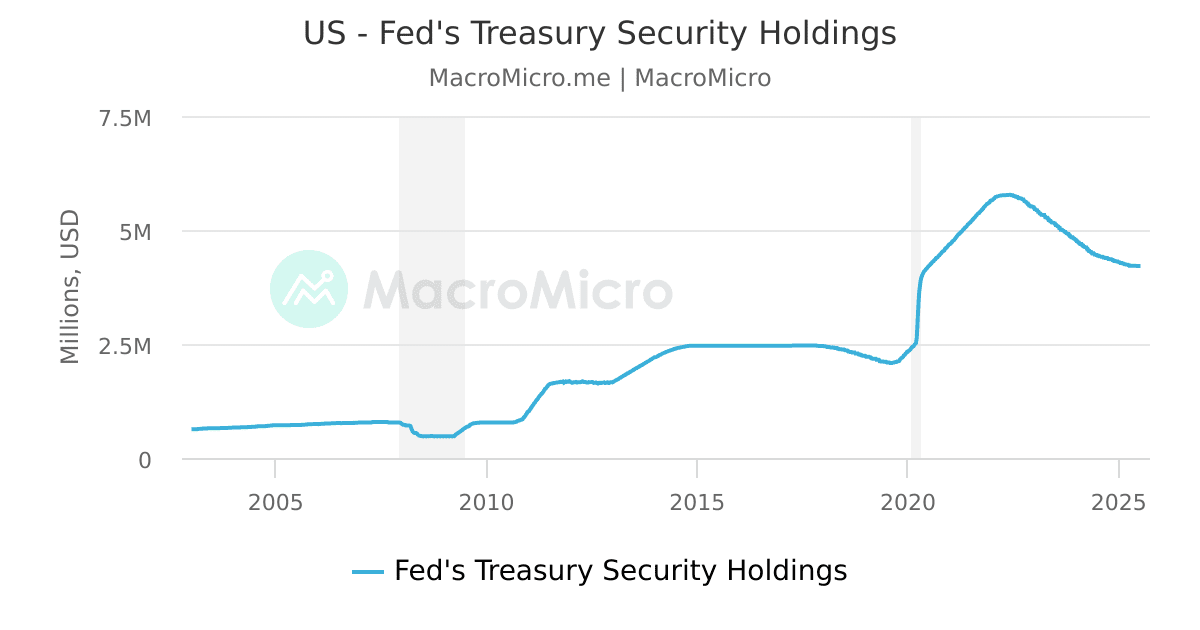

TMUBMUSD10Y | U.S. 10 Year Treasury Note Overview | MarketWatch 2 days ago · TMUBMUSD10Y | A complete U.S. 10 Year Treasury Note bond overview by MarketWatch. View the latest bond prices, bond market news and bond rates. 10 Year Treasury Rate - 54 Year Historical Chart | MacroTrends 10 Year Treasury Rate - 54 Year Historical Chart. Interactive chart showing the daily 10 year treasury yield back to 1962. The 10 year treasury is the benchmark used to decide mortgage rates across the U.S. and is the most liquid and widely traded bond in the world. The current 10 year treasury yield as of August 25, 2022 is 3.03%.

ASX 3 and 10 Year Treasury Bonds Futures and Options 3 and 10 Year Treasury Bond Futures Features The 3 and 10 Year Treasury Bond Futures contracts are ranked amongst the 152 most traded long term interest rate futures contracts in the world today. Average daily turnover in 2016 was 202,000 and 156,000 contracts for the 3 and 10 Year Treasury Bond Futures, respectively.

10 year treasury bond coupon rate

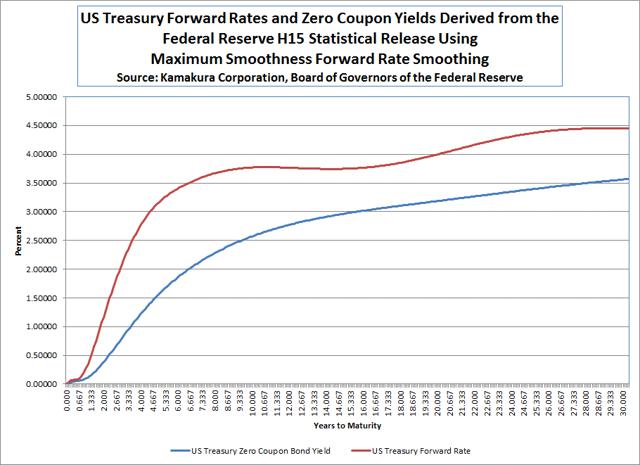

10-Year Treasury Note Definition - Investopedia May 02, 2022 · A 10-year Treasury note is a debt obligation issued by the United States government that matures in 10 years. ... which lowers the coupon rate on new Treasuries and, subsequently, makes older ... 10-Year Treasury Note and How It Works - The Balance Mar 24, 2022 · It's easy to confuse the fixed annual interest rate—the "coupon yield"—with the "yield to maturity" quoted daily on the 10-year treasury. Many people refer to the yield as the Treasury Rate. When people say "the 10-year Treasury rate," they don't always mean the fixed interest rate paid throughout the life of the note. They often mean the ... Interest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data

10 year treasury bond coupon rate. 10 Year Treasury Rate - YCharts Aug 22, 2022 · The 10 year treasury yield is included on the longer end of the yield curve. Many analysts will use the 10 year yield as the "risk free" rate when valuing the markets or an individual security. Historically, the 10 Year treasury rate reached 15.84% in 1981 as the Fed raised benchmark rates in an effort to contain inflation. 10 Year Treasury ... Interest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data 10-Year Treasury Note and How It Works - The Balance Mar 24, 2022 · It's easy to confuse the fixed annual interest rate—the "coupon yield"—with the "yield to maturity" quoted daily on the 10-year treasury. Many people refer to the yield as the Treasury Rate. When people say "the 10-year Treasury rate," they don't always mean the fixed interest rate paid throughout the life of the note. They often mean the ... 10-Year Treasury Note Definition - Investopedia May 02, 2022 · A 10-year Treasury note is a debt obligation issued by the United States government that matures in 10 years. ... which lowers the coupon rate on new Treasuries and, subsequently, makes older ...

Post a Comment for "40 10 year treasury bond coupon rate"