40 ytm zero coupon bond

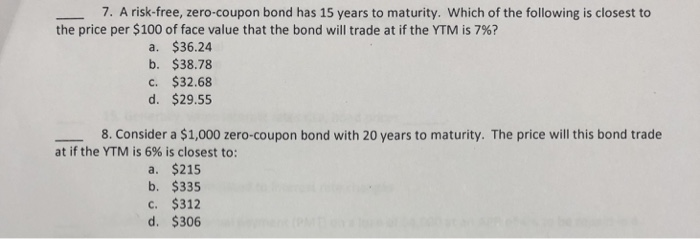

› bond-pricing-formulaBond Pricing Formula | How to Calculate Bond Price? | Examples Since the coupon rate is higher than the YTM, the bond price is higher than the face value, and as such, the bond is said to be traded at a premium. Example #3. Let us take the example of a zero-coupon bond. Let us assume a company QPR Ltd has issued a zero-coupon bond with having a face value of $100,000 and maturing in 4 years. JOHNSON & JOHNSONLS-NOTES 2007(07/24) Bond - Insider The Johnson & Johnson-Bond has a maturity date of 11/6/2024 and offers a coupon of 5.5000%. The payment of the coupon will take place 1.0 times per Year on the 06.11..

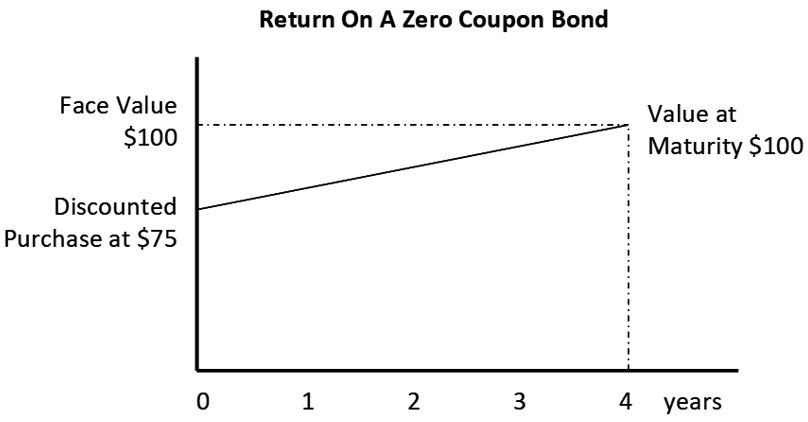

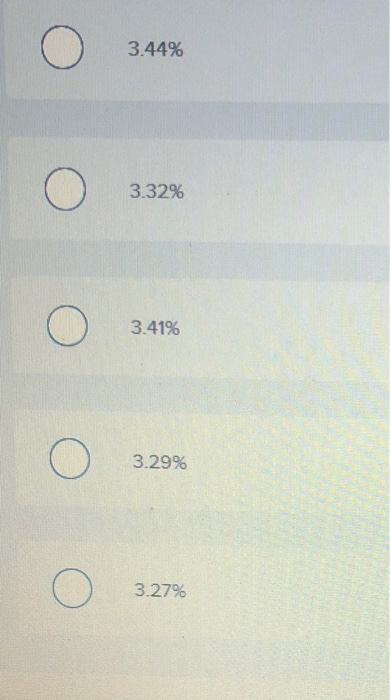

calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months.

Ytm zero coupon bond

Germany Government Bonds - Yields Curve The Germany 10Y Government Bond has a 1.454% yield.. 10 Years vs 2 Years bond spread is 40.5 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 0.50% (last modification in July 2022).. The Germany credit rating is AAA, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation is 16.20 and implied probability of default is 0.27%. Colombia Government Bonds - Yields Curve The Colombia 10Y Government Bond has a 11.960% yield.. 10 Years vs 2 Years bond spread is 102 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 9.00% (last modification in July 2022).. The Colombia credit rating is BB+, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation is 149.16 and implied probability of default is 2.49%. What Is a Zero-Coupon Bond? - The Motley Fool Zero-coupon bonds compensate for not paying any interest over the life of the bond by being available for far less than face value. Put another way, without a deep discount, zero-coupon bonds ...

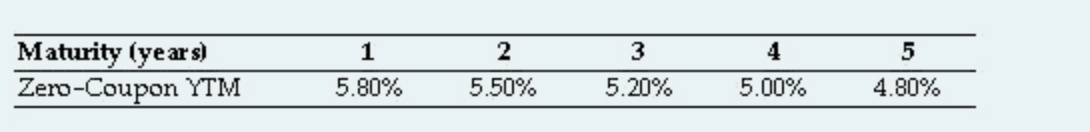

Ytm zero coupon bond. › terms › yYield to Maturity (YTM) - Investopedia May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... Thailand Government Bonds - Yields Curve The Thailand 10Y Government Bond has a 2.450% yield. 10 Years vs 2 Years bond spread is 92 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 0.75% (last modification in August 2022). The Thailand credit rating is BBB+, according to Standard & Poor's agency. Residual Maturity Thailand Yield Curve - 28 Aug 2022 ... calculate-price-of-coupon-bond-from-zero-coupon-bond-price-calculate ... Why could two coupon bonds with the same maturity each have a different yield to maturity? Instructions: Discuss 350 words, 1 referenceThe post calculate-price-of-coupon-bond-from-zero-coupon-bond-price-calculate-yields-of-zero-coupon-bonds first appeared on Term Paper Tutors. Calculating YTM of Coupon Bond based on Information from Zero Coupon ... The YTM are as follows 1-year: 4.7% 2-year: 4.8% 3-year: 5% Given this information, what's the YTM of a three-year risk-free bond with 5% coupon rate and annual coupons? For me, I assume that the coupon payment is $100. So since 5% is $100, 100% is $2,000 which is the face value of the bond.

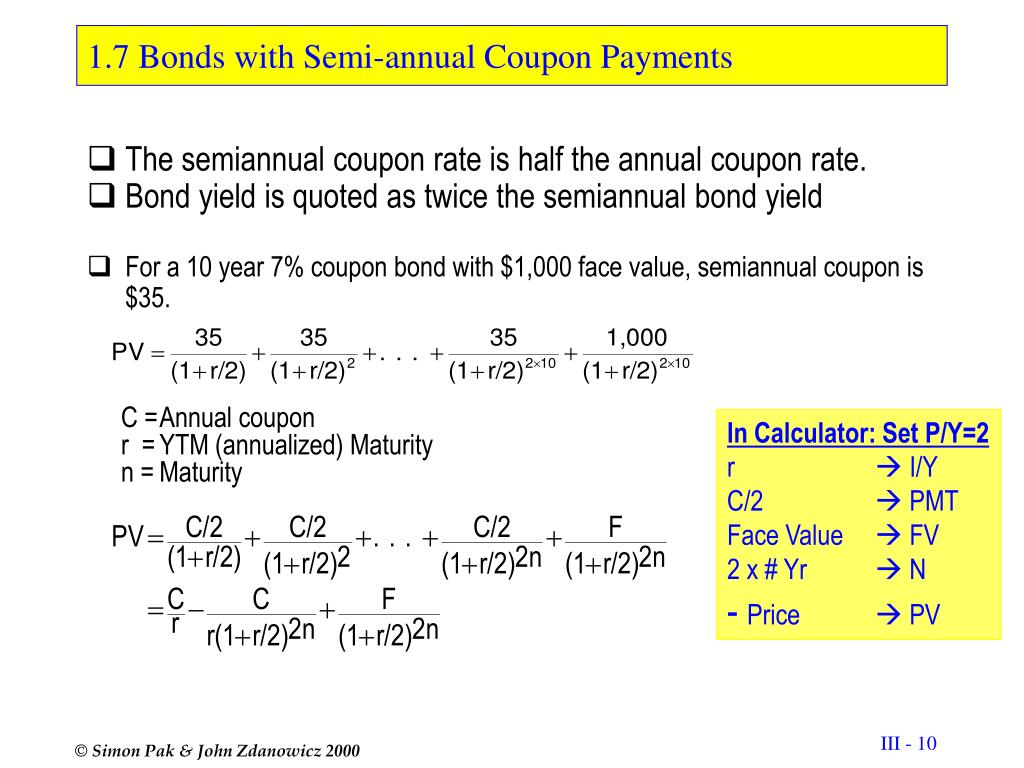

dqydj.com › bond-yield-to-maturity-calculatorBond Yield to Maturity (YTM) Calculator - DQYDJ Yield to Maturity of Zero Coupon Bonds. A zero coupon bond is a bond which doesn't pay periodic payments, instead having only a face value (value at maturity) and a present value (current value). This makes calculating the yield to maturity of a zero coupon bond straight-forward: en.wikipedia.org › wiki › Yield_to_maturityYield to maturity - Wikipedia Finally, a one-year zero-coupon bond of $105 and with a yield to maturity of 5.56%, calculates at a price of 105 / 1.0556^1 or 99.47. Coupon-bearing Bonds [ edit ] For bonds with multiple coupons, it is not generally possible to solve for yield in terms of price algebraically. iShares 0-5 Year Investment Grade Corporate Bond ETF | SLQD The iShares 0-5 Year Investment Grade Corporate Bond ETF seeks to track the investment results of an index composed of U.S. dollar-denominated, investment-grade corporate bonds with remaining maturities of less than five years. ... Average Yield to Maturity as of Aug 25, 2022 4.05% Weighted Avg Coupon as of Aug 25, ... YTM (%) FX Rate Maturity ... › yield-to-maturity-ytmYield to Maturity (YTM) - Wall Street Prep As for our last input, we multiply the semi-annual coupon rate by the face value of the bond (FV) to arrive at the annual coupon of the bond. Yield to Maturity (YTM) Example Calculation. With all required inputs complete, we can calculate the semi-annual yield to maturity (YTM).

Indonesia Government Bonds - Yields Curve The Indonesia 10Y Government Bond has a 7.244% yield. Central Bank Rate is 3.75% (last modification in August 2022). The Indonesia credit rating is BBB, according to Standard & Poor's agency. Current 5-Years Credit Default Swap quotation is 116.42 and implied probability of default is 1.94%. 42 yield of zero coupon bond Bootstrapping | How to Construct a Zero Coupon Yield Curve in Excel? Calculation of zero-coupon discount rate for 2 year - Zero-coupon rate ... Zero-Coupon Swap Definition - Investopedia Zero Coupon Swap: A zero coupon swap is an exchange of income streams in which the stream of floating interest-rate payments is made periodically, as it would be in a plain vanilla swap , but the ... EOF

India Government Bonds - Yields Curve The India 10Y Government Bond has a 7.217% yield.. 10 Years vs 2 Years bond spread is 66.4 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 5.40% (last modification in August 2022).. The India credit rating is BBB-, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation is 107.14 and implied probability of default is 1.79%.

Yield to Maturity vs. Holding Period Return - Investopedia How to Calculate Yield to Maturity of a Zero-Coupon Bond. Fixed Income. Yield to Maturity vs. Coupon Rate: What's the Difference? Fixed Income. Learn to Calculate Yield to Maturity in MS Excel.

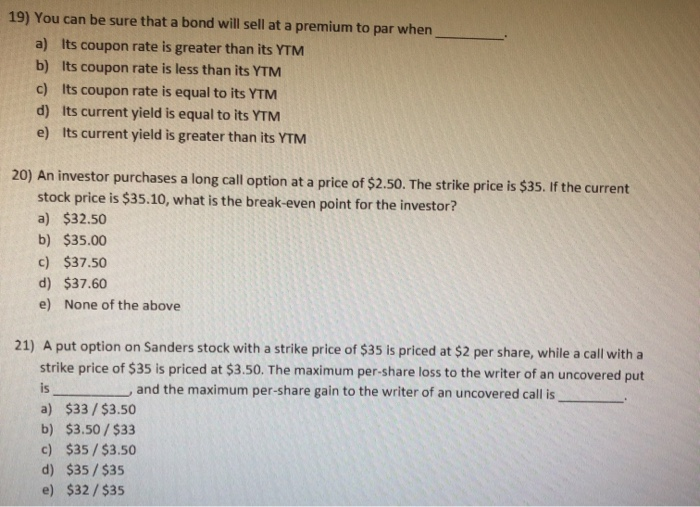

Difference Between Coupon Rate and Yield to Maturity Coupon rate can be stated as the sum of money which a bond issuer has to pay relative to its bond value, while Yield to Maturity (YTM) can be defined as the total money which is to be accepted by an individual after the maturation. The coupon rate is also known as "Yield from the Bond.". This term is used to complicate things at some point ...

Turkey Government Bonds - Yields Curve The Turkey 10Y Government Bond has a 12.940% yield.. 10 Years vs 2 Years bond spread is -125 bp. Yield Curve is inverted in Long-Term vs Short-Term Maturities. Central Bank Rate is 13.00% (last modification in August 2022).. The Turkey credit rating is B+, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation is 723.62 and implied probability of default is 12.06%.

Zero Coupon 2025 Fund | American Century Investments Zero Coupon 2025 Fund - BTTRX. Zero Coupon 2025 Fund. SUMMARY PERFORMANCE COMPOSITION MANAGEMENT. $105.76 | 0.18% ($0.19) NAV as of 08/24/2022. Historical NAV.

investinganswers.com › dictionary › yYield to Maturity (YTM) Definition & Example | InvestingAnswers Mar 10, 2021 · The bond will mature in 6 years and the coupon rate is 5%. To determine the YTM, we’ll use the formula mentioned above: The estimated YTM for this bond is 13.220%. How Yield to Maturity Is Calculated (for Zero Coupon Bonds) Since zero coupon bonds don’t have recurring interest payments, they don’t have a coupon rate.

Bond Valuation - brainmass.com Zero-coupon bonds: A corporation promises to pay a specified amount (typically $1,000) at a future date. This is the face value of the bond. Investors will buy this bond from the corporation at the present value of this one future payment. The present value of a zero coupon bond can be found using the present value formula.

Japan Government Bonds - Yields Curve The Japan 10Y Government Bond has a 0.244% yield.. 10 Years vs 2 Years bond spread is 31.8 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is -0.10% (last modification in January 2016).. The Japan credit rating is A+, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation is 18.90 and implied probability of default is 0.32%.

What Is a Zero-Coupon Bond? - The Motley Fool Zero-coupon bonds compensate for not paying any interest over the life of the bond by being available for far less than face value. Put another way, without a deep discount, zero-coupon bonds ...

Colombia Government Bonds - Yields Curve The Colombia 10Y Government Bond has a 11.960% yield.. 10 Years vs 2 Years bond spread is 102 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 9.00% (last modification in July 2022).. The Colombia credit rating is BB+, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation is 149.16 and implied probability of default is 2.49%.

Germany Government Bonds - Yields Curve The Germany 10Y Government Bond has a 1.454% yield.. 10 Years vs 2 Years bond spread is 40.5 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 0.50% (last modification in July 2022).. The Germany credit rating is AAA, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation is 16.20 and implied probability of default is 0.27%.

Post a Comment for "40 ytm zero coupon bond"