41 zero coupon bonds risk

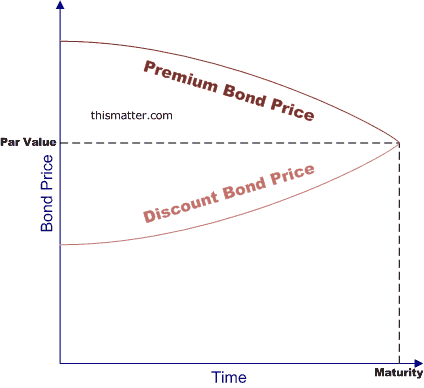

The One-Minute Guide to Zero Coupon Bonds | FINRA.org What Is the Coupon Rate of a Bond? - The Balance Another type of bond is a zero coupon bond, which does not pay interest during the time the bond is outstanding. Rather, zero coupon bonds are sold at a discount to their value at maturity. Maturity dates on zero coupon bonds tend to be long term, often not maturing for 10, 15, or more years.

Zero coupon bonds are back in flavour. Will the party continue? "Zero coupon bonds are highly beneficial when the interest rates are high and there is no re-investment risk during the life period of the bond for the investors," said Srinivasan of Rockfort...

Zero coupon bonds risk

zero coupon bonds: Latest News & Videos, Photos about zero coupon bonds ... zero coupon bonds Latest Breaking News, Pictures, Videos, and Special Reports from The Economic Times. zero coupon bonds Blogs, Comments and Archive News on Economictimes.com ... BloombergJust as an everything rally propels records in the S&P 500 and inflates risk assets, the bond market is emitting a warning signal to investors that a rapid ... What Is a Zero-Coupon Bond? - The Motley Fool With zero-coupon bonds, interest rate risk is at its highest since zeros display unusual sensitivity to changes in interest rates -- although the underlying inverse relationship to interest rates... RBI orders five banks to list zero coupon bonds at "fair value" A zero-coupon bond is not an interest bearing security. Unlike other bonds, it does not pay interest regularly. These are issued at deep discounts to their face value and are redeemed at face value on the maturity date. For example, a Rs 100 face value bond maturing in 10 years could be issued at Rs. 55.

Zero coupon bonds risk. What are Bonds? | Definition & Types | Beginner's Guide Typically, the higher a bond's rating, the lower the coupon needs to be because of the lower risk of default by the issuer. Non-investment grade bonds (also known as junk or high-yield bonds) usually carry Standard and Poor's ratings of "BB+" to "D" or "Baa1" to "C" for Moody's. Deferred Coupon Bonds | Definition, How it works? Types, Advantages Deferred coupon bonds can be Zero-coupon bonds for a specific period of time and then pay a certain interest for the remaining period till maturity. For example, a deferred coupon bond with 4 years as a deferred period with a coupon of 6% will not pay any interest for the first four years from the issuance date. After these initial 4 years, 6% ... What is a Zero-Coupon Bond? - Realonomics Zero-coupon bonds are the only fixed-income security that has no investment risk as no coupon payments are made. Reinvestment risk is most prevalent when it comes to bond investing, but any sort of investment that produces cash flow will expose the investor to this kind of risk. What is another name for zero-coupon bond? Zero-Coupon CDs: What They Are And How They Work | Bankrate The biggest disadvantage of a zero-coupon CD is you'll have to pay taxes on the accrued interest each year even though you haven't received it yet. As Renfro sees it, anyone looking to invest in a...

What Are Corporate Bonds? What You Need To Know | GOBankingRates - Zero-coupon bonds do not pay periodic interest, but are sold at a discount to the face value. When the bond matures, the face value is paid to the investor. Are corporate bonds high risk? Most corporate bonds are not high risk, because they pay a pre-determined amount of interest over a pre-determined period of time. Zero coupon, zero principal bond declared securities The Finance Ministry has declared zero coupon zero principal instruments (ZCZP) as securities. ... such bonds are not without risk, as there is no guarantee that the social impact that an NPO (Non ... Record Run for Zero-Interest Convertible Bonds Hits a Wall Investors gobbled up convertible bonds with zero coupon from companies including Airbnb, SoFi, Snap, Ford, DraftKings, Twitter, Shake Shack, Spotify and Dish Network. They were essentially lending... What are Zero Coupon Bonds? Types, Advantages & Disadvantages Risks Associated with Zero Coupon Bonds Compared to other types of investments, Zero Coupon Bonds have the potential to yield higher returns. In this case, the investor does not receive any interest during the bond's life. Instead, they are simply investing money and waiting for it to mature. One of the most notable is inflation risk.

Zero Coupon 2025 Fund | American Century Investments Investment in zero-coupon securities is subject to greater price risk than interest-paying securities of similar maturity. Although you can potentially earn a dependable return if you hold your shares to maturity, you should be prepared for dramatic price fluctuations which may result in significant gains or losses if sold prior to maturity. C Original Issue Discount - Explained - The Business Professor, LLC Original Issue Discount and Zero-Coupon Bonds. Zero-coupon bonds are defined as bonds that have the highest original issue discounts. Investors make a profit or the OID only when the bond matures and pay the bond's face value. ... Since zero-coupon bonds don't pay interest, they are considered as low-risk investments because interest rate ... What are zero-coupon bonds? - moneycontrol.com Zero coupon bonds are issued at a discount to the face value of the bond. They do not pay interest during the tenure of the security. The investor of the zero coupon bond receives the face value of... What Is a Zero Coupon Yield Curve? - Smart Capital Mind A zero coupon bond does not pay interest but instead carries a discount to its face value. The investor therefore receives one payment of the face value of the bond on its maturity. This face value is the equivalent of the principal invested plus interest over the life of the bond.

Zero-Coupon Bond Definition - Investopedia Zero-coupon bonds are like other bonds, in that they do carry various types of risk, because they are subject to interest rate risk if investors sell them before maturity. How Does a Zero-Coupon...

Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value. Reinvestment risk is not relevant for zero-coupon bonds, but interest rate risk is relevant for the bonds. Understanding Zero-Coupon Bonds As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value.

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Unique Risks of Zero-Coupon U.S. Treasury Bonds Because of their sensitivity to interest rates, zero-coupon Treasury bonds have incredibly high interest rate risk. Treasury zeros fall significantly...

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing Bonds that are rated "B" or lower are considered "speculative grade," and they carry a higher risk of default than investment-grade bonds. Zero-Coupon Bonds. A zero-coupon bond is a bond without coupons, and its coupon rate is 0%. The issuer only pays an amount equal to the face value of the bond at the maturity date.

For a zero-coupon bond? Explained by FAQ Blog Zero-coupon bonds are the only fixed-income security that has no investment risk as no coupon payments are made. Reinvestment risk is most prevalent when it comes to bond investing, but any sort of investment that produces cash flow will expose the investor to this kind of risk. Why is lower coupon rate high risk?

Post a Comment for "41 zero coupon bonds risk"