38 irs quarterly payment coupon

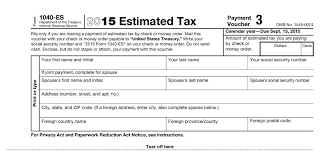

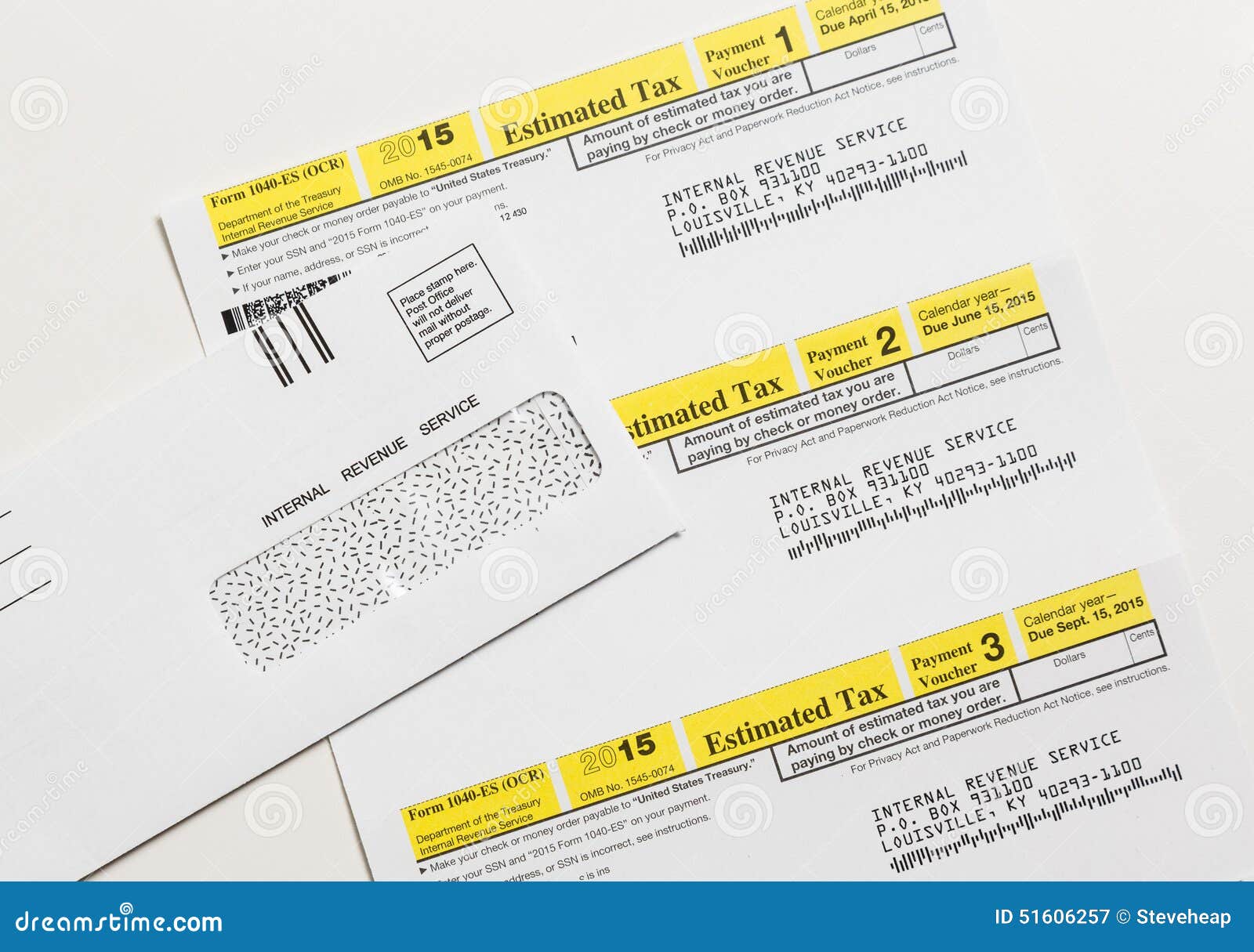

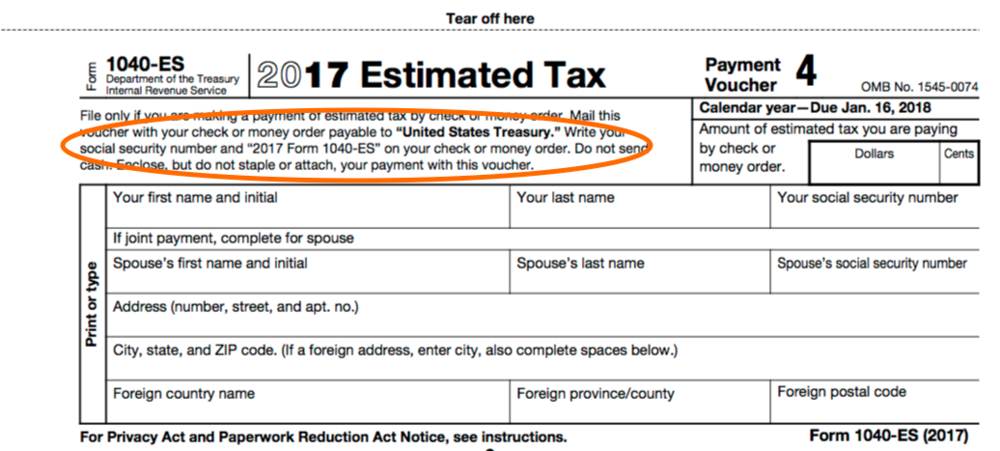

Publication 1212 (01/2022), Guide to Original Issue Discount ... For a stripped bond or coupon acquired after 1984, and before April 4, 1994, an accrual period is each 6-month period that ends on the day that corresponds to the stated maturity date of the stripped bond (or payment date of a stripped coupon) or the date 6 months before that date. 2021 Form 1040-ES - IRS You can make more than four estimated tax payments. To do so, make a copy of one of your unused estimated tax payment vouchers, fill it in, and mail it with ...

IRS Free File: Do your Taxes for Free - IRS tax forms Oct 17, 2022 · Each IRS Free File company will provide you information when you don’t qualify, with a link back to the IRS.gov Free File site. Seek help if you need it: If you need help when you are at a company’s IRS Free File site and doing your taxes, you may refer to the company’s free customer service options. IRS can help find a free option for you.

Irs quarterly payment coupon

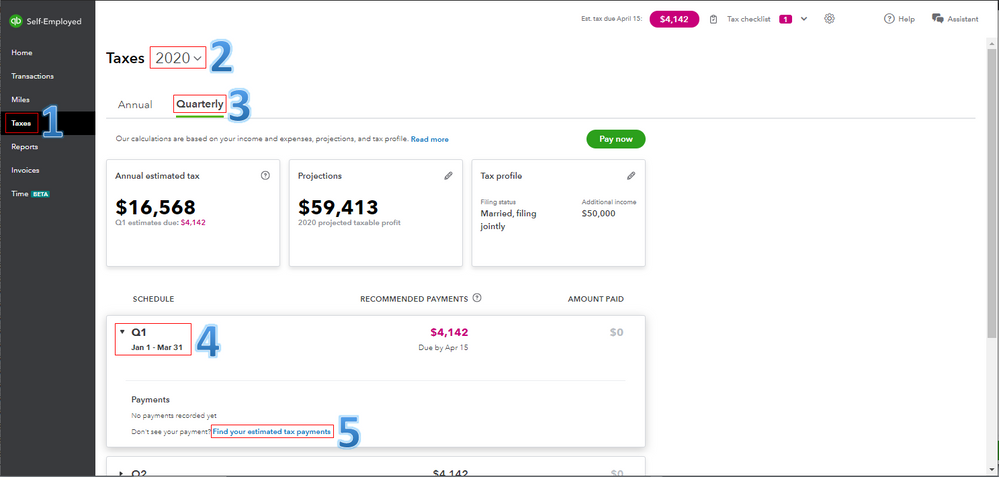

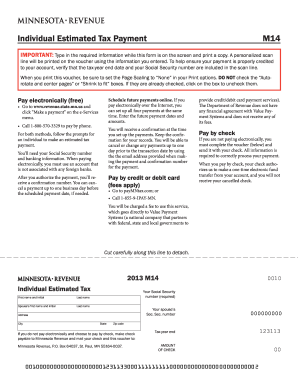

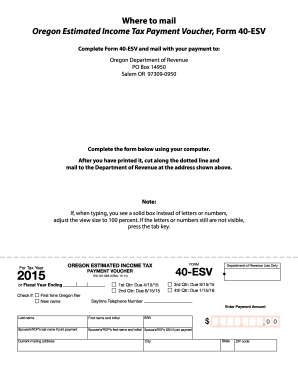

Estimated Tax | Internal Revenue Service Answer: · Crediting an overpayment on your 2021 return to your 2022 estimated tax · Mailing your payment (check or money order) with a payment voucher from Form ... Publication 463 (2021), Travel, Gift, and Car Expenses ... Go to IRS.gov/OrderForms to order current forms, instructions, and publications; call 800-829-3676 to order prior-year forms and instructions. The IRS will process your order for forms and publications as soon as possible. Don’t resubmit requests you’ve already sent us. You can get forms and publications faster online. Estimated Taxes | Internal Revenue Service Taxes must be paid as you earn or receive income during the year, either through withholding or estimated tax payments. If the amount of income tax withheld ...

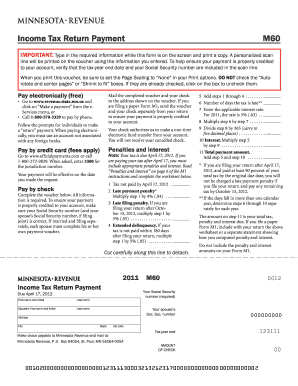

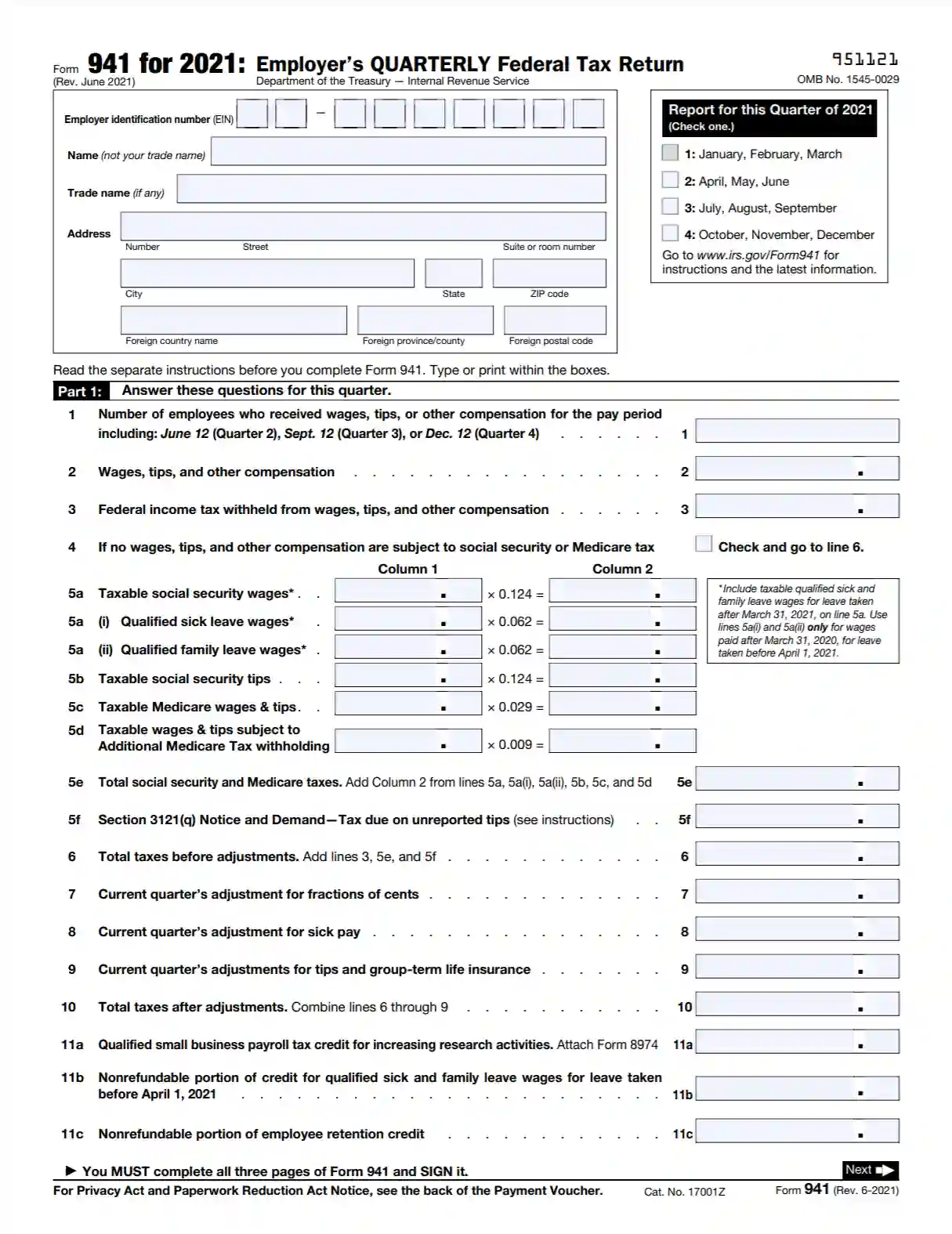

Irs quarterly payment coupon. 2022 Form 1040-ES (NR) - IRS Mar 1, 2022 ... You can make more than four estimated tax payments. To do so, make a copy of one of your unused estimated tax payment vouchers, fill it in, and ... Paying a Balance Due (Lockbox) for Individuals - IRS The IRS uses lockboxes which are a collection and processing service provided by a network of financial institutions. Use your Form 1040-V, Payment Voucher. Payments | Internal Revenue Service - IRS tax forms Oct 04, 2022 · View the amount you owe, your payment plan details, payment history, and any scheduled or pending payments. Make a same day payment from your bank account for your balance, payment plan, estimated tax, or other types of payments. 2022 Federal Quarterly Estimated Tax Payments | It's Your Yale Generally, the Internal Revenue Service (IRS) requires you to make quarterly estimated tax payments for calendar year 2022 if both of the following apply:.

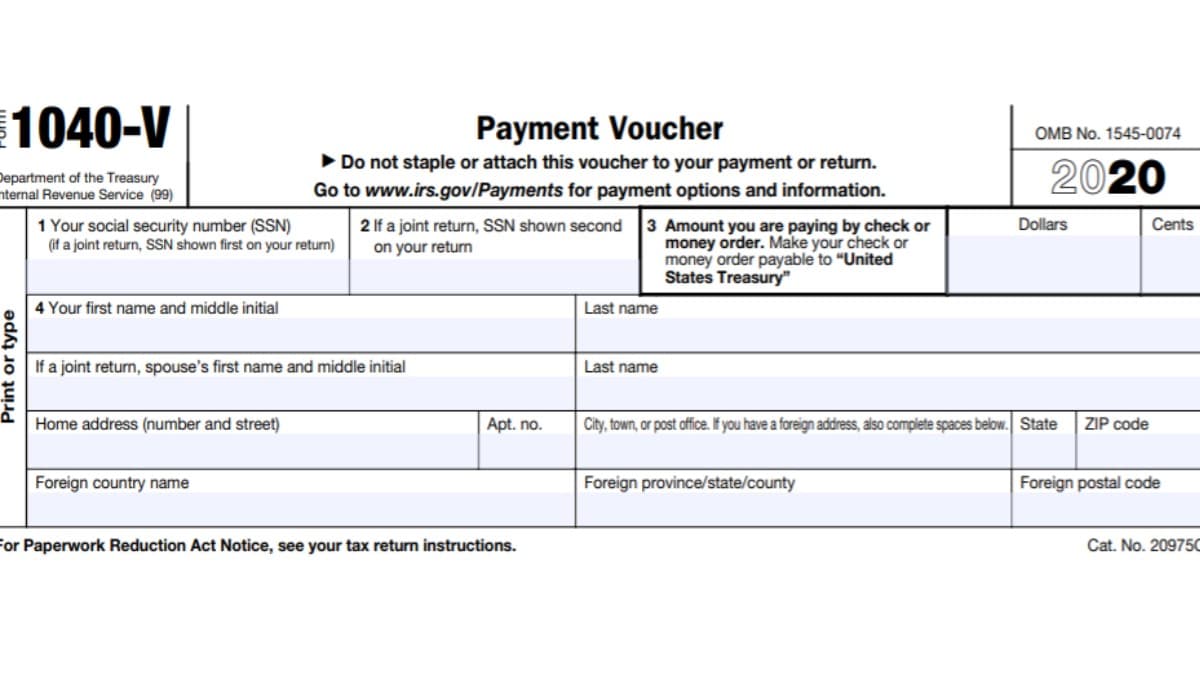

About Form 1040-V, Payment Voucher | Internal Revenue Service Aug 26, 2022 ... More In Forms and Instructions ... Form 1040-V is a statement you send with your check or money order for any balance due on the “Amount you owe” ... Publication 505 (2022), Tax Withholding and Estimated Tax If a 2022 Form W-4P is used for withholding for payments beginning in 2022, and you don't give the payer your SSN in the required manner or the IRS notifies the payer before any payment or distribution is made that you gave an incorrect SSN, tax will be withheld as if your filing status is single, with no adjustments in Steps 2 through 4. Internal Revenue Bulletin: 2004-33 - IRS tax forms Aug 16, 2004 · Q-19. A health plan which otherwise qualifies as an HDHP generally requires a 10 percent coinsurance payment after a covered individual satisfies the deductible. However, if an individual fails to get pre-certification for a specific provider, the plan requires a 20 percent coinsurance payment. About Form 1040-ES, Estimated Tax for Individuals - IRS Sep 23, 2022 ... More In Forms and Instructions ... Use Form 1040-ES to figure and pay your estimated tax. Estimated tax is the method used to pay tax on income ...

2022 Form 1040-ES - IRS Jan 24, 2022 ... You can make more than four estimated tax payments. To do so, make a copy of one of your unused estimated tax payment vouchers, fill it in, and ... 2022 Form 1040-V - IRS Do not staple or attach this voucher to your payment or return. Go to for payment options and information. OMB No. 1545-0074. Publication 15-B (2022), Employer's Tax Guide to Fringe ... Moving expense reimbursements. P.L. 115-97, Tax Cuts and Jobs Act, suspends the exclusion for qualified moving expense reimbursements from your employee's income for tax years beginning after 2017 and before 2026. However, the exclusion is still available in the case of a member of the U.S. Armed Forces on active duty who moves because of a permane Estimated Taxes | Internal Revenue Service Taxes must be paid as you earn or receive income during the year, either through withholding or estimated tax payments. If the amount of income tax withheld ...

Publication 463 (2021), Travel, Gift, and Car Expenses ... Go to IRS.gov/OrderForms to order current forms, instructions, and publications; call 800-829-3676 to order prior-year forms and instructions. The IRS will process your order for forms and publications as soon as possible. Don’t resubmit requests you’ve already sent us. You can get forms and publications faster online.

Estimated Tax | Internal Revenue Service Answer: · Crediting an overpayment on your 2021 return to your 2022 estimated tax · Mailing your payment (check or money order) with a payment voucher from Form ...

Post a Comment for "38 irs quarterly payment coupon"