43 bond coupon interest rate

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Annual Interest Payment = Amount of Interest * Frequency of Payment. Annual Interest Payment = 10 * 2. Annual Interest Payment = Rs. 20. Coupon Rate is calculated using the formula given below. Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100. Coupon Rate = (20 / 100) * 100. Bond Prices, Rates, and Yields - Fidelity Coupon rate—The higher a bond or CD's coupon rate, or interest payment, the higher its yield. That's because each year the bond or CD will pay a higher percentage of its face value as interest. Price—The higher a bond or CD's price, the lower its yield. That's because an investor buying the bond or CD has to pay more for the same return.

Rising interest rates to mute bond issuance this fiscal: Icra Ratings ... Corporate bond issuance for this fiscal is likely to remain muted, witnessing 4-5 per cent growth to touch touch ₹ 41.42 lakh crore on rising coupon rates, despite the drawdown more than ...

Bond coupon interest rate

› terms › cCoupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... en.wikipedia.org › wiki › Zero-coupon_bondZero-coupon bond - Wikipedia A strip bond has no reinvestment risk because the payment to the investor occurs only at maturity. The impact of interest rate fluctuations on strip bonds, known as the bond duration, is higher than for a coupon bond. A zero coupon bond always has a duration equal to its maturity, and a coupon bond always has a lower duration. Coupon Bond - Guide, Examples, How Coupon Bonds Work Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. In this case, Apple will pay $5 in annual interest to investors for every bond purchased. After four years, on the bond's maturity date, Apple will make its last coupon payment.

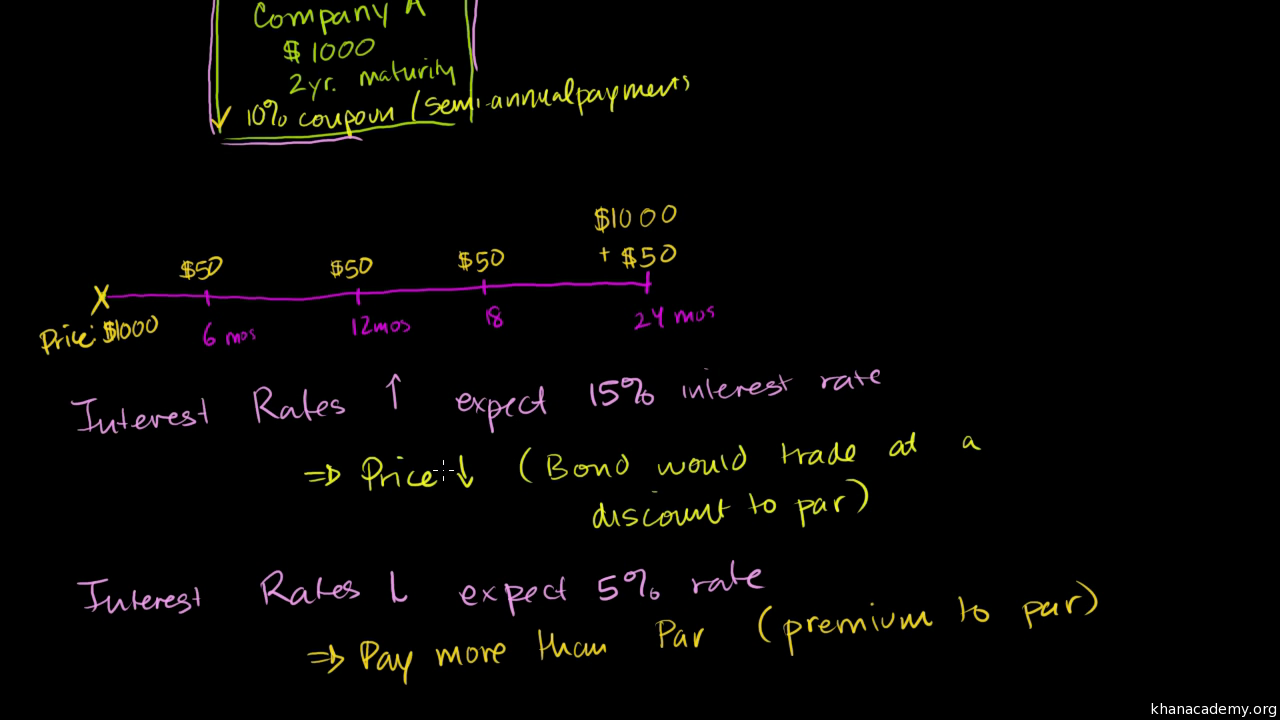

Bond coupon interest rate. Bond prices and interest rates | Manulife Investment Management To understand how bonds are priced, take a hypothetical 5-year, 4% coupon bond as an example. If the general market interest rate rises from 4% to 5%, yields on newly issued bonds will reflect the higher rate. Naturally, this renders existing 4% bonds less attractive. The lower-yielding 4% bond would therefore decrease in price and would have ... What Is a Fixed-Rate Bond? - Investopedia A fixed-rate bond is a debt instrument with a level interest rate over its entire term, with regular interest payments known as coupons. Upon maturity of the bond, holders will receive... › ask › answersBond Coupon Interest Rate: How It Affects Price - Investopedia Dec 18, 2021 · For instance, a bond with a $1,000 face value and a 5% coupon rate is going to pay $50 in interest, even if the bond price climbs to $2,000, or conversely drops to $500. But if a bond's coupon ... Rising interest rates to mute bond issuance this fiscal: Report Mumbai: Corporate bond issuance is likely to remain muted witnessing 4-5 per cent growth this fiscal to touch Rs 41.42 lakh crore on rising coupon rates, despite the drawdown more than doubling in the second quarter, a report said. Bond sales more than doubled to Rs 2.1 lakh crore in the second quarter from the first quarter, when it was at a ...

Coupon Rate vs Interest Rate | Top 8 Best Differences (with Infographics) Difference Between Coupon Rate vs Interest Rate. A coupon rate refers to the rate which is calculated on face value of the bond i.e., it is yield on the fixed income security that is largely impacted by the government set interest rates and it is usually decided by the issuer of the bonds whereas interest rate refers to the rate which is charged to borrower by lender, decided by the lender and it is manipulated by the government depending totally on the market conditions › what-is-the-coupon-rateWhat Is the Coupon Rate of a Bond? - The Balance ABC bond's coupon rate was 3%, based on a par value of $1,000 for the bond. This translates to $30 of interest paid each year. Let's say Investor 1 purchases the bond for $900 in the secondary market but still receives the same $30 in interest. This translates to a current yield of 3.33%. en.wikipedia.org › wiki › Bond_(finance)Bond (finance) - Wikipedia The coupon is the interest rate that the issuer pays to the holder. For fixed rate bonds, the coupon is fixed throughout the life of the bond. For floating rate notes, the coupon varies throughout the life of the bond and is based on the movement of a money market reference rate (often LIBOR). 'Rising interest rates to mute bond issuance this fiscal' Share. Corporate bond issuance is likely to remain muted witnessing 4-5 per cent growth this fiscal to touch `41.42 lakh crore on rising coupon rates, despite the drawdown more than doubling in ...

Rising Interest Rates Hit Banks' Bond Holdings - WSJ Photo: John Taggart for The Wall Street Journal. The Federal Reserve's rapid interest-rate increases have created an unusual and potentially worrisome gap between the value companies place on ... What Is a Bond Coupon, and How Is It Calculated? - Investopedia If the bond later trades for $900, the current yield rises to 7.8% ($70 ÷ $900). The coupon rate, however, does not change, since it is a function of the annual payments and the face value,... Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate is the amount of annual interest income paid to a bondholder, based on the face value of the bond. Government and non-government entities issue bonds to raise money to finance their operations. When a person buys a bond, the bond issuer promises to make periodic payments to the bondholder, based on the principal amount of the bond, at the coupon rate indicated in the issued certificate. If the market rate of interest is greater than the coupon rate the bond ... 55. If the market rate of interest is greater than the coupon rate, the bond will be valued: A. Less than par. B. At par. C. Greater than par. D. Cannot be determined. 56. What is the present value of a three-year security that pays a fixed annual coupon of 6 percent using a discount rate of 7 percent? A. 92.48 B. 100.00 C. 101.75 D. 97.38. 57.

en.wikipedia.org › wiki › Bond_valuationBond valuation - Wikipedia For example, for small interest rate changes, the duration is the approximate percentage by which the value of the bond will fall for a 1% per annum increase in market interest rate. So the market price of a 17-year bond with a duration of 7 would fall about 7% if the market interest rate (or more precisely the corresponding force of interest ...

Rising interest rates to mute bond issuance this fiscal, says report ... Corporate bond issuance is likely to remain muted witnessing 4-5 per cent growth this fiscal to touch Rs 41.42 lakh crore on rising coupon rates, despite the drawdown more than doubling in the second quarter, a report said. Bond sales more than doubled to Rs 2.1 lakh crore in the second quarter from the first quarter, when it was at a multi ...

As the Fed Raises Rates, Worries Grow About Corporate Bonds The steep rise in interest rates has caused bond values to tumble: ... The interest rate on a big chunk of its debt issued this year that matures in 2030 is 10.25 percent. Its bonds are trading at ...

I bonds interest rates — TreasuryDirect the interest on I bonds is a combination of a fixed rate a inflation rate Current Interest Rate Series I Savings Bonds 6.89% For savings bonds issued November 1, 2022 to April 30, 2023. Fixed rate You know the fixed rate of interest that you will get for your bond when you buy the bond. The fixed rate never changes.

What Is Coupon Rate and How Do You Calculate It? - SmartAsset Coupon rate could also be considered a bond's interest rate. In our example above, the $1,000 pays a 10% interest rate. Investors use the phrase "coupon rate" for two reasons. First, a bond's interest rate can often be confused for its yield rate, which we'll get to in a moment. The term "coupon rate" specifies the rate of payment relative to a bond's par value.

› terms › bBond: Financial Meaning With Examples and How They Are Priced Jul 01, 2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ...

What Is a Bond Coupon? - The Balance A bond's coupon refers to the amount of interest due and when it will be paid. 1 A $100,000 bond with a 5% coupon pays 5% interest. The broker takes your payment and deposits the bond into your account when you invest in a newly issued bond through a brokerage account. There it sits alongside your stocks, mutual funds, and other securities.

Rising interest rates to mute bond issuance this fiscal: Report Nov 13, 202202:08. Corporate bond issuance is likely to remain muted witnessing 4-5 per cent growth this fiscal to touch Rs 41.42 lakh crore on rising coupon rates, despite the drawdown more than doubling in the second quarter, a report said. Bond sales more than doubled to Rs 2.1 lakh crore in the second quarter from the first quarter, when it ...

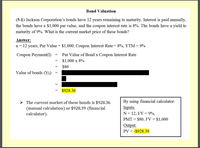

Coupon Bond Formula | How to Calculate the Price of Coupon Bond? The company plans to issue 5,000 such bonds, and each bond has a par value of $1,000 with a coupon rate of 7%, and it is to mature in 15 years. The effective yield to maturity is 9%. Determine the price of each bond and the money to be raised by XYZ Ltd through this bond issue. Below is given data for the calculation of the coupon bond of XYZ Ltd.

Coupon Rate: Formula and Bond Calculation - Wall Street Prep Par Value = $100,000. Coupon Rate = 6%. Annual Coupon = $100,000 x 6% = $6,000. Since most bonds pay interest semi-annually, the bondholder receives two separate coupon payments of $3k each year for as long as the bond is still outstanding. Number of Periods (N) = 2. Coupon Payment = $6,000 / 2 = $3,000.

Coupon Rate Formula | Step by Step Calculation (with Examples) Dave said that the coupon rate is 10.00% Harry said that the coupon rate is 10.53% Annual Coupon Payment Annual coupon payment = 4 * Quarterly coupon payment = 4 * $25 = $100 Therefore, the coupon rate of the bond can be calculated using the above formula as, Coupon Rate of the Bond will be - Therefore, Dave is correct.

Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo Since the coupon (6%) is lower than the market interest (7%), the bond will be traded at a discount . Since the coupon (6%) is equal to the market interest (7%), the bond will be traded at par. Since the coupon (6%) is higher than the market interest (5%), the bond will be traded at a premium. Drivers of Coupon Rate of a Bond

Coupon Bond - Guide, Examples, How Coupon Bonds Work Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. In this case, Apple will pay $5 in annual interest to investors for every bond purchased. After four years, on the bond's maturity date, Apple will make its last coupon payment.

en.wikipedia.org › wiki › Zero-coupon_bondZero-coupon bond - Wikipedia A strip bond has no reinvestment risk because the payment to the investor occurs only at maturity. The impact of interest rate fluctuations on strip bonds, known as the bond duration, is higher than for a coupon bond. A zero coupon bond always has a duration equal to its maturity, and a coupon bond always has a lower duration.

› terms › cCoupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

.png)

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "43 bond coupon interest rate"