44 is yield to maturity the same as coupon rate

Difference Between Coupon Rate and Yield to Maturity The main difference between Coupon Rate and Yield to Maturity (YTM) is that Coupon Rate is the fixed sum of money that a person has to pay at face value. In contrast, Yield to Maturity (YTM) is the amount a person will retrieve after the maturation of their bonds. The Coupon Rate is said to be the same throughout the bond tenure year. Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision Therefore, if the 5-Year Treasury Yield becomes 4%, still the coupon rate will remain 5%, and if the 5-Year Treasury Yield increases to 12% yet, the coupon rate will remain 10%. Coupon Rate Vs. Yield to Maturity. Many people get confused between coupon rate and yield to maturity. In reality, both are very different measures of returns. As ...

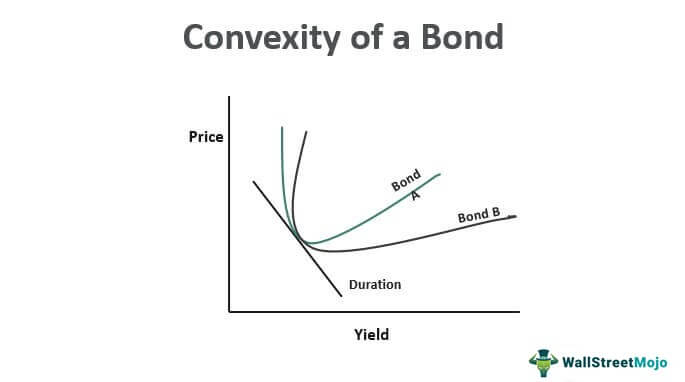

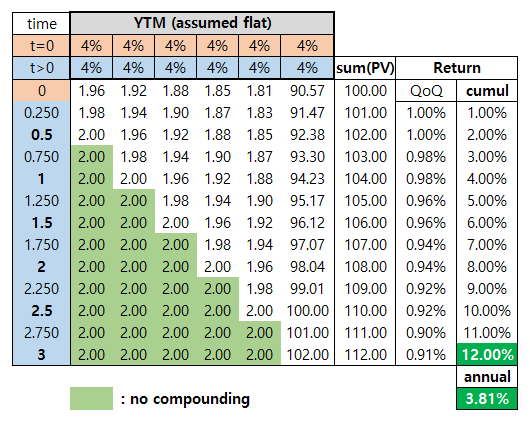

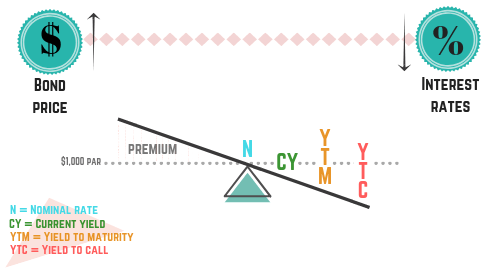

The Relation of Interest Rate & Yield to Maturity - Zacks The yield to maturity is the yield that you would earn if you held the bond to maturity and were able to reinvest the coupon payments at that same rate. It is the same number used in the bond ...

Is yield to maturity the same as coupon rate

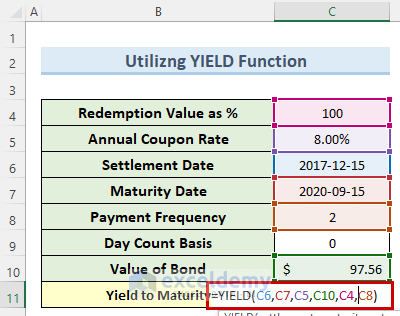

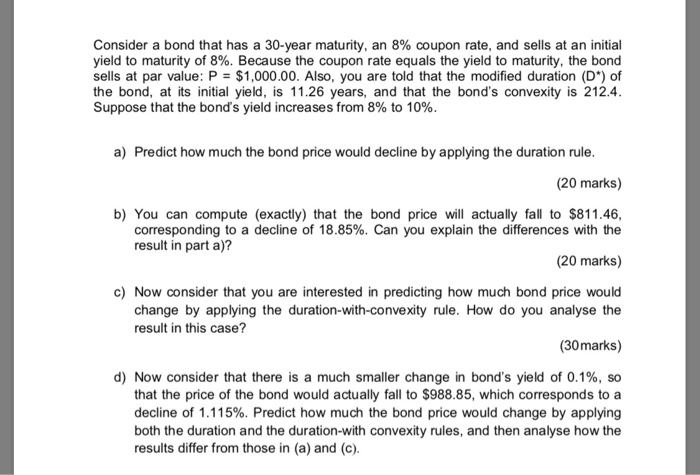

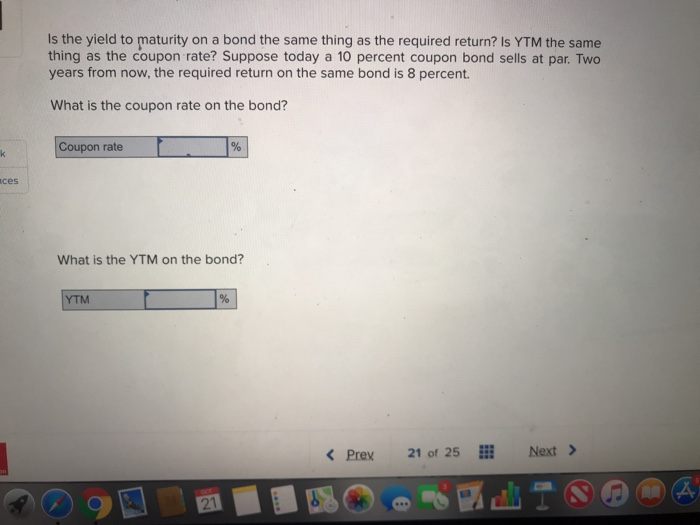

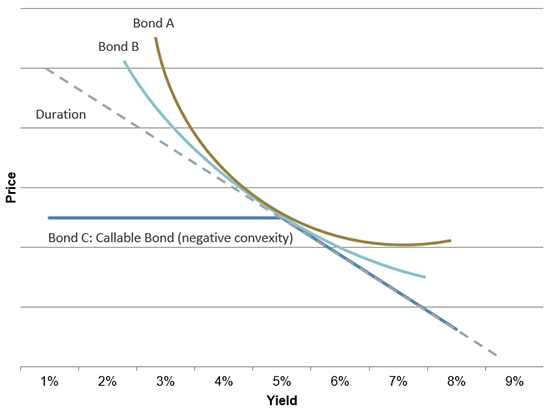

FIN 221 Exam 1 Flashcards | Quizlet If a bond's yield to maturity exceeds its coupon rate, the bond's current yield must also exceed its coupon rate. b. If a bond's yield to maturity exceeds its coupon rate, the bond's price must be less than its maturity value. c. If two bonds have the same maturity, the same yield to maturity, and the same level of risk, the Difference between Coupon Rate And Yield To Maturity The primary difference between coupon rate and yield to maturity is that the coupon rate stays the same throughout the tenure of the bond. However, the yield to maturity undergoes a change depending on various factors such as the years remaining till maturity and the current price at which the bond is being traded. Is the Yield to Maturity on a Bond the Same Thing As the Required ... If you paid $1,000 for the bond, your yield is 5 percent — the same as the coupon rate. If you paid $990.57 for the bond, your yield is 6 percent — you get the same $1,050 back, but it now represents a 6 percent return on your initial investment. If you paid $1,009.62 for the bond, your yield falls to 4 percent.

Is yield to maturity the same as coupon rate. Difference Between Yield to Maturity and Coupon Rate The key difference between yield to maturity and coupon rate is that yield to maturity is the rate of return estimated on a bond if it is held until the maturity date, whereas coupon rate is the amount of annual interest earned by the bondholder, which is expressed as a percentage of the nominal value of the bond. CONTENTS 1. Basics Of Bonds - Maturity, Coupons And Yield - InCharge Debt Solutions As the price of a bond goes up, its yield goes down, and vice versa. If you buy a new bond at par and hold it to maturity, your current yield when the bond matures will be the same as the coupon yield. Yield-to-Maturity (YTM) is the rate of return you receive if you hold a bond to maturity and reinvest all the interest payments at the YTM rate ... investinganswers.com › dictionary › yYield to Maturity (YTM) Definition & Example | InvestingAnswers Mar 10, 2021 · Is Yield to Maturity the Same as Coupon Rate? The yield to maturity is the percentage of the rate of return for a fixed-rate security should an investor hold onto the asset until maturity. The coupon rate is simply the amount of interest an investor will receive. Also known as nominal yield or the yield from the bond, the coupon rate doesn’t ... Given the following zero-coupon yields, compare the yield to maturity ... From the information provided, the yield to maturity of the three-year zero-coupon bond is 4.50%. Also, because the yields match those in Table 6.7, we already calculated the yield to maturity for the 10% coupon bond as 4.44%. To compute the yield for the 4% coupon bond, we first need to calculate its price, which we can do using Eq. 6.4.

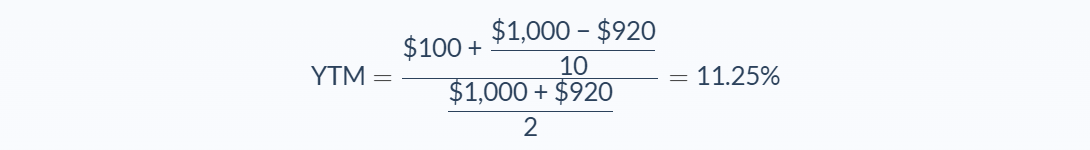

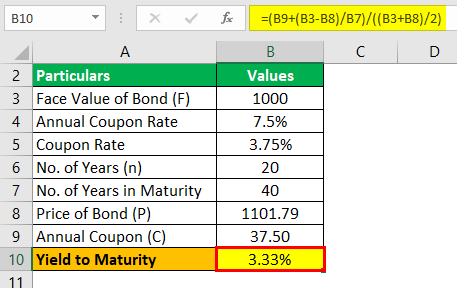

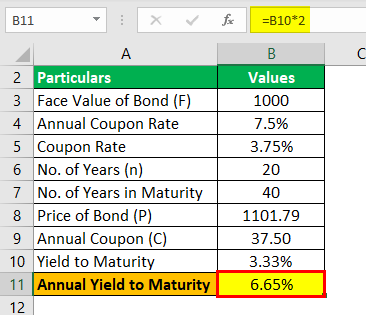

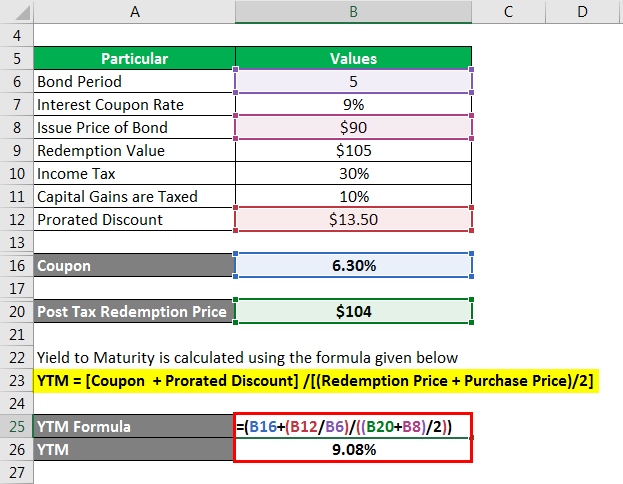

Understanding Coupon Rate and Yield to Maturity of Bonds The resulting YTM will differ from the Coupon Rate. This is simply because interest rates change daily. To prove this point, say a month later you decide to purchase the same RTB 03-11 in the secondary market. However, Interest rates increased. From 2.375%, quoted yield increased to 2.700%. Can yield to maturity be higher than coupon rate? - Sage-Answer Is current yield the same as coupon rate? ... If a bond's yield to maturity exceeds its coupon rate, the bond will sell at a discount below par. Three $1,000 par value, 10-year bonds have the same amount of risk, hence their yields to maturity are equal. How do you calculate coupon rate? Yield to Maturity (YTM) - Overview, Formula, and Importance On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity Coupon Rate - Learn How Coupon Rate Affects Bond Pricing Coupon Rate vs. Yield-to-Maturity. The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when ...

Coupon Rate and Yield to Maturity | How to Calculate Coupon Rate The coupon rate represents the actual amount of interest earned by the bondholder annually while the yield to maturity is the estimated total rate of return ... Coupon vs Yield | Top 8 Useful Differences (with Infographics) - EDUCBA The coupon amount is the amount that is paid out semi-annually or annually till the maturity date on the face value of the bond. While current yield generates the return annually depend on the market price fluctuation. Coupon rates are more likely influenced by the interest rates fixed by the government body on the basis country's economy. Is the Yield to Maturity on a Bond the Same Thing As the Required ... If you paid $1,000 for the bond, your yield is 5 percent — the same as the coupon rate. If you paid $990.57 for the bond, your yield is 6 percent — you get the same $1,050 back, but it now represents a 6 percent return on your initial investment. If you paid $1,009.62 for the bond, your yield falls to 4 percent. Difference between Coupon Rate And Yield To Maturity The primary difference between coupon rate and yield to maturity is that the coupon rate stays the same throughout the tenure of the bond. However, the yield to maturity undergoes a change depending on various factors such as the years remaining till maturity and the current price at which the bond is being traded.

FIN 221 Exam 1 Flashcards | Quizlet If a bond's yield to maturity exceeds its coupon rate, the bond's current yield must also exceed its coupon rate. b. If a bond's yield to maturity exceeds its coupon rate, the bond's price must be less than its maturity value. c. If two bonds have the same maturity, the same yield to maturity, and the same level of risk, the

:max_bytes(150000):strip_icc()/dotdash_Final_Par_Yield_Curve_Apr_2020-01-3d27bef7ca0c4320ae2a5699fb798f47.jpg)

Post a Comment for "44 is yield to maturity the same as coupon rate"