43 value of zero coupon bond

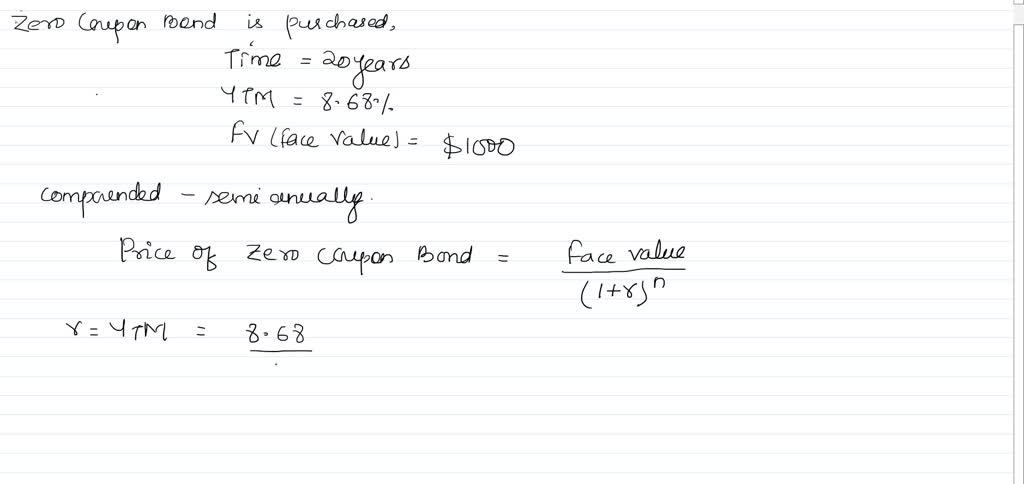

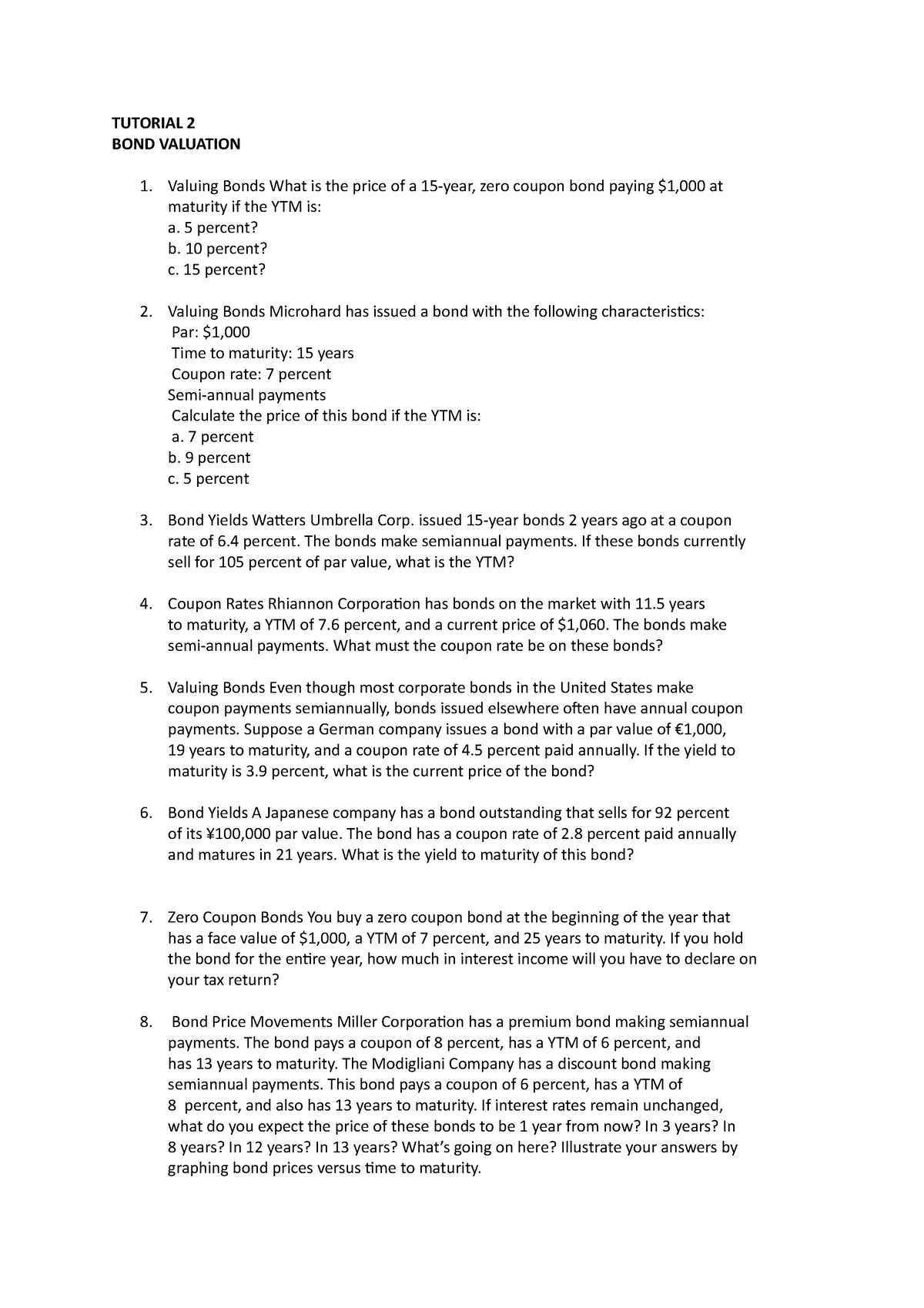

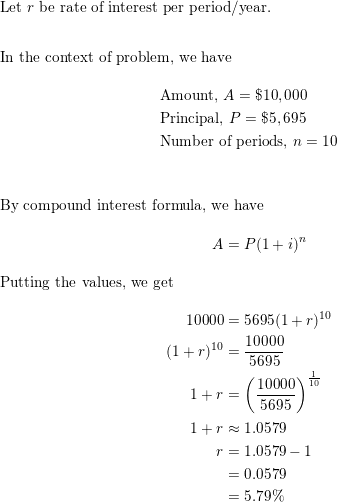

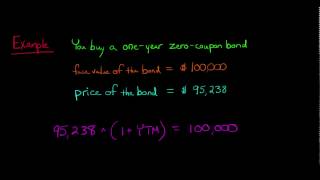

Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator The value of a zero-coupon bond is determined by its face value, maturity date, and the prevailing interest rate. The formula to calculate the value of a zero-coupon bond is Price = M / (1+r)n where: M = maturity value or face value of the bond r = rate of interest required n = number of years to maturity 3. Zero Coupon Bond Calculator - What is the Market Value? The zero coupon bond price formula is: \frac {P} { (1+r)^t} (1+ r)tP where: P: The par or face value of the zero coupon bond r: The interest rate of the bond t: The time to maturity of the bond Zero Coupon Bond Pricing Example Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000

Solved A 3-year zero coupon bond is priced at $900 with a | Chegg.com Finance questions and answers. A 3-year zero coupon bond is priced at $900 with a par value of $1000. A. Calculate its YTM B. Show amortization schedule for this bond. Show full calculations in table below. Amortization Schedule for the Zero Coupon Bond Year Investment Value Interest Earned 0. Question: A 3-year zero coupon bond is priced at ...

Value of zero coupon bond

Zero Coupon Bond Calculator - Nerd Counter For instance, the maturity period of a zero-coupon bond is 10-years, its par value is $1000, the interest rate is 5.00%. When we are calculating the bond price in Excel, suppose we use the B column of the excel sheet for entering the values where B2 is the face value, B3 is the maturity time period, B4 is the interest rate. What Is a Zero-Coupon Bond? - Investopedia The price of a zero-coupon bond can be calculated as: Price = M ÷ (1 + r) n where: M = Maturity value or face value of the bond r = required rate of interest n = number of years until... Value and Yield of a Zero-Coupon Bond | Formula & Example - XPLAIND.com Find the value of the zero-coupon bond as at 31 December 2013 and Andrews expected income for the financial year 20X3 from the bonds. Value of Total Holding = 100 × $553.17 = $55,317 Expected accrued income = Value at the end of a period − Value at the start of a period = $55,317 − $50,000 = $5,317

Value of zero coupon bond. How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816) Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. Answered: The yield to maturity of a one-year,… | bartleby Business Economics The yield to maturity of a one-year, risk-free, zero-coupon bond with a $10,000 face value and a price of $8,063 when released is _%. (round your answer to two decimal places) The yield to maturity of a one-year, risk-free, zero-coupon bond with a $10,000 face value and a price of $8,063 when released is _%. ... Zero Coupon Bond: Definition, Features & Formula Therefore, the purchase price and face value are the only two cash flows that are present with zero-coupon bonds. Example of a Zero-Coupon Bonds. Let's say that Investor X is looking to purchase a zero-coupon bond with a face value of $10,000. This bond has 5 years to maturity and an interest rate of 5% which is compounded annually.

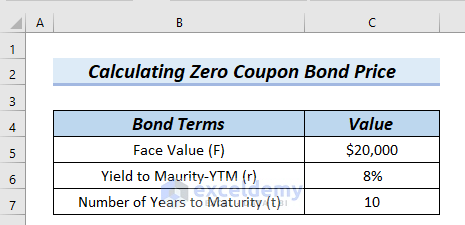

Traditional Zero Coupon Bonds Explained - BondsIndia Zero-coupon bonds are an investment that can make your money grow sustainably through the wonders of compound interest. Bonds are typically seen as a simple, lo ... When does a bond have a Par Value? The interest payments on a bond are based on the par value, not the bond's market price. A bond's par value is the face value of the bond ... Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. Zero Coupon Bond Value Formula - Crunch Numbers Yield to maturity for zero-coupon bonds is calculated as: YTM = \sqrt[n]{ \frac{Face\;value}{Current\;price} } - 1 Example of YTM of a zero-coupon bond calculation. Let's assume an investor wants to buy a zero-coupon bond and wants to evaluate what YTM of this bond would be. The face value of the bond is $10,000. The price of the bond is ...

How to Calculate Bond Value: 6 Steps (with Pictures) - wikiHow Apr 19, 2021 · Assume that a bond has a face value of $1,000 and a coupon rate of 6%. The annual interest is $60. Divide the annual interest amount by the number of times interest is paid per year. For zero coupon bonds? Explained by FAQ Blog What is a zero-coupon bond Mcq? A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference between the purchase price of a zero-coupon bond and the par value, indicates the investor's return. Zero-Coupon Bond - Definition, How It Works, Formula To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond; r is the required rate of return or interest rate; and n is the number of years until maturity. Note that the formula above assumes that the interest rate is compounded annually. What are Zero-Coupon Bonds? (Characteristics + Calculator) Zero-Coupon Bond – Bondholder Return. The return to the investor of a zero-coupon bond is equal to the difference between the face value of the bond and its purchase price. In exchange for providing the capital in the first place and agreeing not to be paid interest, the purchase price for a zero-coupon is less than its face value.

Bond Price & Duration & Convexity Calculations.xlsx View Notes - Bond Price & Duration & Convexity Calculations.xlsx from FINANCE 009LON at Coventry University. ANNUAL BOND Par Value 1,000.00 Coupon Rate 0.10 Maturity 5.00 YTM 0.08 Time Periods Cash

Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond.

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia If a zero-coupon bond is purchased for $1,000 and given away as a gift, the gift giver will have used only $1,000 of their yearly gift tax exclusion. The recipient, on the other hand, will...

Bond (finance) - Wikipedia The interest payment ("coupon payment") divided by the current price of the bond is called the current yield (this is the nominal yield multiplied by the par value and divided by the price). There are other yield measures that exist such as the yield to first call, yield to worst, yield to first par call, yield to put, cash flow yield and yield ...

Coupon Bond Vs. Zero Coupon Bond: What's the Difference? Aug 31, 2020 · A zero-coupon bond does not pay coupons or interest payments like a typical bond does; instead, a zero-coupon holder receives the face value of the bond at maturity.

Zero Coupon Bond Value Calculator How to calculate Zero Coupon Bond Value using this online calculator? To use this online calculator for Zero Coupon Bond Value, enter Face Value (F), Rate of Return (%RoR) & Time to Maturity (T) and hit the calculate button. Here is how the Zero Coupon Bond Value calculation can be explained with given input values -> 675.5642 = 1000/(1+4/100)^10.

Bonds Flashcards | Quizlet A zero-coupon bond has a yield to maturity of 9% and a par value of $1,000. If the bond matures in eight years, the bond should sell for a price of _____ today. ... Consider the following $1,000 par value zero-coupon bonds: Bond YTM Price A 1 $909.90 B 2 $811.62 C 3 $711.78 D 4 $635.52 The yield to maturity on bond A is A. 10%. B. 11%. C. 12% ...

Zero Coupon Bond Value Calculator: Calculate Price, Yield to ... Here is an example calculation for the purchase price of a $1,000,000 face value bond with a 10 year duration and a 6% annual interest rate. 20. Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P ...

Zero Coupon Bonds_1 | Investing Post Most zero coupon bonds carry a face value that is paid to the holder of the bond at a fixed maturity date but interest rates may vary and actual bond returns become unpredictable. If the market conditions increase and interest rates rise, choosing a bond investment rather than other options may bring a lower return.

Value and Yield of a Zero-Coupon Bond | Formula & Example - XPLAIND.com Find the value of the zero-coupon bond as at 31 December 2013 and Andrews expected income for the financial year 20X3 from the bonds. Value of Total Holding = 100 × $553.17 = $55,317 Expected accrued income = Value at the end of a period − Value at the start of a period = $55,317 − $50,000 = $5,317

What Is a Zero-Coupon Bond? - Investopedia The price of a zero-coupon bond can be calculated as: Price = M ÷ (1 + r) n where: M = Maturity value or face value of the bond r = required rate of interest n = number of years until...

Zero Coupon Bond Calculator - Nerd Counter For instance, the maturity period of a zero-coupon bond is 10-years, its par value is $1000, the interest rate is 5.00%. When we are calculating the bond price in Excel, suppose we use the B column of the excel sheet for entering the values where B2 is the face value, B3 is the maturity time period, B4 is the interest rate.

Post a Comment for "43 value of zero coupon bond"